PRODUCTS

the big get bigger: the largest pcb fabricators in japan and taiwan stretched their leads in 2005.

by:Rocket PCB

2019-12-10

At this time of year, we make an annual list of the world\'s largest PCB manufacturers.

As pointed out in the past, it is increasingly difficult to collect accurate data on board sales each year: (many)

Manufacturers of flexible circuits are increasingly involved in assembly, making it increasingly difficult to separate assembly sales from bare-metal sales.

Therefore, the data collected, especially from flex makers, is sometimes not clear, which is inevitable.

As Taiwanese manufacturers expand production in China, there is quite a bit of \"duplication\" in their data \".

Similar situations are common among Japanese manufacturers.

In 2005, PCB manufacturers made less than $100 million a year, which is too vague.

To prevent reporting errors, these companies were not ranked.

2005 of the rankings include companies that earn more than $100 million a year.

There were 93 such PCB manufacturers last year, two more than in 2004. (

However, with the expansion of the Asia-Pacific region, this number may soon exceed 100, and the list for next year may have to be changed to NTI-100+. )

The author would like to thank all PCB manufacturers who provide data to make this report possible.

I take full responsibility for any mistakes.

If necessary, income has been transferred to the United StatesS. dollars.

The exchange rate used is: Japan: 110 yen South Korea: 1024 won China: 8.

Taiwan 1 yuan: NT $32. 5 Europe: 0.

Table 1 of € 84 lists PCB manufacturers with revenues of more than $100 million in 2005.

As mentioned earlier, where possible, the assembly part of flexcircuits has been eliminated, but sometimes there is ambiguity, and the interpretation of the data is at the discretion of the reader.

This year, Japan has the largest number of entries again, with 34, followed by Taiwan and 25. The U. S.

13 projects with revenues of more than $100 million ranked third.

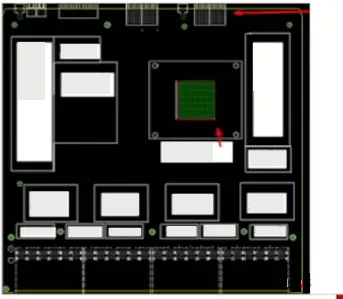

Figure 1 and Figure 2 show the number of participants and total output of representative manufacturers in each region.

It is often said that 20% of manufacturers in many industries supply 80% of their products.

Does this apply to the PCB industry?

A total of $42.

The world has produced 1 billion worth of plates.

70% of the buildings were built by the top 93 manufacturers (TABLE 2).

Also, top PCB-

Production areas account for 99% of world production.

Top 93 manufacturers (3.

Pcb manufacturers in the world estimate 3%)

Companies with revenues of $100 million and above produced a total of $29.

The value of PCBs last year was 6 billion.

70% of world output.

According to the author\'s survey, about 50 manufacturers earn between $50 million and $100 million, and their revenues add up to about $3. 6 billion.

This makes the total output of the top 145 manufacturers (4. 8%)

About $33.

2 billion, accounting for about 72% of world output.

If we expand the number of manufacturers to include top300--

About 10% of the world\'s manufacturers-

Total output is estimated to reach 90% per cent.

Therefore, the 20/80 rule does not apply for today\'s pcb industry.

Insteadit is actually the \"10/90 rule\" because 10% of the value of the products produced by the manufacturer is 90%.

There are many exceptions, of course, especially among Taiwanese manufacturers, but overall the trend is that large manufacturers are getting bigger and bigger.

In 2000, when the IT bubble peaked, the United StatesS. -

Of the top 20 manufacturers headquartered, Sanmina-

SCI topped the list for $1.

Revenue was $53 billion, followed by the Viasystems Group, which earned $1. 25 billion.

Five other companies are at a high level.

The situation has completely changed over time.

There were only three in America last year. S. -

The top 20 manufacturers are all in a lower position.

All of Viasystems\'s income now comes from China.

At Multek, 85% of the revenue comes from China, a proportion that is rising.

Innovex has moved almost all of its production to its subsidiaries in Thailand.

Parlex has been acquired and is no longer based in the United States. S.

Maybe we shouldn\'t classify these vandals as Americans any more. S. companies!

Financial performance income is one thing, financial performance is another thing.

Table 3 shows the financial performance of select NTI

Listed manufacturers based on financial disclosure.

The authors chose these manufacturers on the basis that these data are relatively readily available. After-tax (AT)

Profits depend on tax credits.

For many Taiwanese manufacturers, profits are greater than operating profits.

This phenomenon is beyond the scope of the author\'s understanding.

Many PCB manufacturers lament that profits are elusive, but some companies are very profitable, as shown in the table.

Please note that thatIbiden, Nippon Mektron and Shinko Electric are part of largerorganization, and in each case the PCB part of the business exceeds the company.

Interestingly, the profit (if any) of many privately owned Japanese manufacturers is quite low.

Since the tax rate is very high, usually more than 40%, they often allow the cancellation of as many equipment as possible according to the law, and assign a certain amount of profits to employees according to the label of \"special bonus.

\"The income tax paid by individuals is much lower than the corporate tax rate, thus saving money.

At the same time, these special bonuses also enhance the ethics of employees.

As a result, direct explanations of financial reports may be misleading in private enterprises in Japan.

Japan continues to invest at $2. Between $3 billion and $2.

More than 5 billion 2006-07 timeframe.

Despite concerns about overcapacity, more than 30 Taiwanese pcb manufacturers are still expanding in China.

Total investment exceeded $1 billion.

These investments, combined with their current leadership, mean that Japan and Taiwan will certainly have a larger ranking share in the coming years.

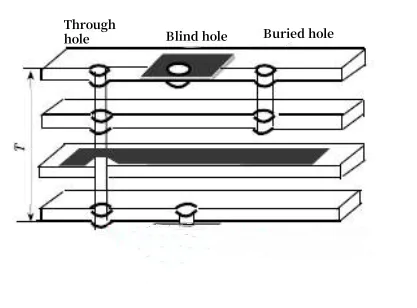

One of the main drivers of growth is the microvia technology in the mobile phone motherboard and package substrate, both of which grow 50% faster than the pcb as a whole.

All the fastest

More and more companies are involved in at least one of these two areas, many of which are involved.

Taiwan exchange sales-

In the first six months of this year, Taiwan\'s listed manufacturers grew by 37%.

It was a bit slow in June and the second half of the year, but the business seems to be getting stronger.

Due to the new mobile phone business and continuous high exports, PCB demand in Japan is also very strong.

Flat digital camera

Television, games, automotive electronics and other electronics.

As a result, the share of PCB manufacturers in both countries continues to grow.

Sales of at least seven manufacturers could exceed $1 billion in 2006: Ibiden, Nippon Mektron, CMK, ShinkoElectric, Samsung TECO

Mechanical, Unimicron and Nanya PCB. DR.

Hayao nakahara is president of NT Information and consultant editor of the China National Development Council.

You can contact him at nakanti @ yahoo. com.

As pointed out in the past, it is increasingly difficult to collect accurate data on board sales each year: (many)

Manufacturers of flexible circuits are increasingly involved in assembly, making it increasingly difficult to separate assembly sales from bare-metal sales.

Therefore, the data collected, especially from flex makers, is sometimes not clear, which is inevitable.

As Taiwanese manufacturers expand production in China, there is quite a bit of \"duplication\" in their data \".

Similar situations are common among Japanese manufacturers.

In 2005, PCB manufacturers made less than $100 million a year, which is too vague.

To prevent reporting errors, these companies were not ranked.

2005 of the rankings include companies that earn more than $100 million a year.

There were 93 such PCB manufacturers last year, two more than in 2004. (

However, with the expansion of the Asia-Pacific region, this number may soon exceed 100, and the list for next year may have to be changed to NTI-100+. )

The author would like to thank all PCB manufacturers who provide data to make this report possible.

I take full responsibility for any mistakes.

If necessary, income has been transferred to the United StatesS. dollars.

The exchange rate used is: Japan: 110 yen South Korea: 1024 won China: 8.

Taiwan 1 yuan: NT $32. 5 Europe: 0.

Table 1 of € 84 lists PCB manufacturers with revenues of more than $100 million in 2005.

As mentioned earlier, where possible, the assembly part of flexcircuits has been eliminated, but sometimes there is ambiguity, and the interpretation of the data is at the discretion of the reader.

This year, Japan has the largest number of entries again, with 34, followed by Taiwan and 25. The U. S.

13 projects with revenues of more than $100 million ranked third.

Figure 1 and Figure 2 show the number of participants and total output of representative manufacturers in each region.

It is often said that 20% of manufacturers in many industries supply 80% of their products.

Does this apply to the PCB industry?

A total of $42.

The world has produced 1 billion worth of plates.

70% of the buildings were built by the top 93 manufacturers (TABLE 2).

Also, top PCB-

Production areas account for 99% of world production.

Top 93 manufacturers (3.

Pcb manufacturers in the world estimate 3%)

Companies with revenues of $100 million and above produced a total of $29.

The value of PCBs last year was 6 billion.

70% of world output.

According to the author\'s survey, about 50 manufacturers earn between $50 million and $100 million, and their revenues add up to about $3. 6 billion.

This makes the total output of the top 145 manufacturers (4. 8%)

About $33.

2 billion, accounting for about 72% of world output.

If we expand the number of manufacturers to include top300--

About 10% of the world\'s manufacturers-

Total output is estimated to reach 90% per cent.

Therefore, the 20/80 rule does not apply for today\'s pcb industry.

Insteadit is actually the \"10/90 rule\" because 10% of the value of the products produced by the manufacturer is 90%.

There are many exceptions, of course, especially among Taiwanese manufacturers, but overall the trend is that large manufacturers are getting bigger and bigger.

In 2000, when the IT bubble peaked, the United StatesS. -

Of the top 20 manufacturers headquartered, Sanmina-

SCI topped the list for $1.

Revenue was $53 billion, followed by the Viasystems Group, which earned $1. 25 billion.

Five other companies are at a high level.

The situation has completely changed over time.

There were only three in America last year. S. -

The top 20 manufacturers are all in a lower position.

All of Viasystems\'s income now comes from China.

At Multek, 85% of the revenue comes from China, a proportion that is rising.

Innovex has moved almost all of its production to its subsidiaries in Thailand.

Parlex has been acquired and is no longer based in the United States. S.

Maybe we shouldn\'t classify these vandals as Americans any more. S. companies!

Financial performance income is one thing, financial performance is another thing.

Table 3 shows the financial performance of select NTI

Listed manufacturers based on financial disclosure.

The authors chose these manufacturers on the basis that these data are relatively readily available. After-tax (AT)

Profits depend on tax credits.

For many Taiwanese manufacturers, profits are greater than operating profits.

This phenomenon is beyond the scope of the author\'s understanding.

Many PCB manufacturers lament that profits are elusive, but some companies are very profitable, as shown in the table.

Please note that thatIbiden, Nippon Mektron and Shinko Electric are part of largerorganization, and in each case the PCB part of the business exceeds the company.

Interestingly, the profit (if any) of many privately owned Japanese manufacturers is quite low.

Since the tax rate is very high, usually more than 40%, they often allow the cancellation of as many equipment as possible according to the law, and assign a certain amount of profits to employees according to the label of \"special bonus.

\"The income tax paid by individuals is much lower than the corporate tax rate, thus saving money.

At the same time, these special bonuses also enhance the ethics of employees.

As a result, direct explanations of financial reports may be misleading in private enterprises in Japan.

Japan continues to invest at $2. Between $3 billion and $2.

More than 5 billion 2006-07 timeframe.

Despite concerns about overcapacity, more than 30 Taiwanese pcb manufacturers are still expanding in China.

Total investment exceeded $1 billion.

These investments, combined with their current leadership, mean that Japan and Taiwan will certainly have a larger ranking share in the coming years.

One of the main drivers of growth is the microvia technology in the mobile phone motherboard and package substrate, both of which grow 50% faster than the pcb as a whole.

All the fastest

More and more companies are involved in at least one of these two areas, many of which are involved.

Taiwan exchange sales-

In the first six months of this year, Taiwan\'s listed manufacturers grew by 37%.

It was a bit slow in June and the second half of the year, but the business seems to be getting stronger.

Due to the new mobile phone business and continuous high exports, PCB demand in Japan is also very strong.

Flat digital camera

Television, games, automotive electronics and other electronics.

As a result, the share of PCB manufacturers in both countries continues to grow.

Sales of at least seven manufacturers could exceed $1 billion in 2006: Ibiden, Nippon Mektron, CMK, ShinkoElectric, Samsung TECO

Mechanical, Unimicron and Nanya PCB. DR.

Hayao nakahara is president of NT Information and consultant editor of the China National Development Council.

You can contact him at nakanti @ yahoo. com.

Custom message