Top 100+ Global PCB Companies in 2021

Top 100+ global PCB Companies in 2021

This list is from the list of top 100 global PCB enterprises (ranking according to the output value of global PCB enterprises in 2020) released by Dr. Hayao Nakahara of NTI at the end of July 2021 for reference.

This is his 25th ranking of global PCB enterprise output value. Thank him for the valuable data he has provided for the PCB industry in the past 25 years.

According to the data released by Dr. Hayao Nakahara at the end of July 2021, the total output value of 127 enterprises in 2020 was US $68.672 billion, an increase of 8.9% over US $63.044 billion in 2019. The enterprises listed in the top 100 list are PCB enterprises with an output value of more than US $100 million.

The top ten PCB enterprises in the world are ZDT (Taiwan), Unimicron / umtc (Taiwan), DSBJ, (domestic), Nippon Mektron (Japan), TTM (US), Compeq (Taiwan), Tripod (Taiwan), Shennan Circuit (SCC, domestic), Ibiden (Japan) and HannStar (Taiwan). Taiwan investment is the largest, accounting for 5 seats; Chinese domestic investment occupies 2 seats.

Global market

1. From the perspective of subdivided products: the demand for HDI and Flex PCB is lower than expected, but the demand for high multilayer PCB and high-end IC substrate board is strong;

2. From the perspective of product application: the demand for mobile phones and automotive electronics is gradually released, and the demand for communication base stations, servers and computers is booming;

3, From the production area: output value of traditional PCB manufacturing countries such as Japan and Korea has been declining in recent years, but the Chinese mainland has continued to grow (the impact of the COVID-19 on 2020 will decrease globally, but then it will rebound).

| Top 100+ Global PCB companies in 2021 /$100 million | ||||||

| Ranking | Name | Chinese Name | Head Square | 2019 | 2020 | Growth rate |

| 1 | ZDT | 臻鼎科技 | Taiwan, China | 40.8 | 44.54 | 9.2% |

| 2 | Unimicron | 欣兴电子 | Taiwan, China | 28.01 | 29.82 | 6.5% |

| 3 | DSBJ | 东山精密 | China | 21.5 | 27.19 | 26.5% |

| 4 | Nippon Metron* | 旗胜 | Japan | 26.52 | 26.39 | -0.5% |

| 5 | TTM | 迅达科技 | U.S.A | 22.38 | 21.05 | -5.9% |

| 6 | Compeq | 华通 | Taiwan, China | 19.06 | 20.54 | 7.8% |

| 7 | Tripod | 健鼎 | Taiwan, China | 18.51 | 18.85 | 1.8% |

| 8 | Shennan Circuits | 深南电路 | China | 15.25 | 16.8 | 10.2% |

| 9 | Ibiden | Ibiden | Japan | 12.38 | 15.56 | 25.7% |

| 10 | Hann Star | 瀚宇博德 | Taiwan, China | 14.64 | 15.51 | 5.9% |

| 11 | SEMCO | 星电机 | Korea | 10.43 | 14.93 | 43.1% |

| 12 | KBPCB | 建滔 | Hong Kong, China | 12.53 | 13.7 | 9.3% |

| 13 | AT&S | 奥特斯 | Austria | 11.53 | 13.6 | 18.0% |

| 14 | NanyaPCB | 南亚 | Taiwan, China | 10.55 | 13.07 | 23.9% |

| 15 | Wus group | 楠梓 | Taiwan, China | 12.05 | 12.43 | 3.2% |

| 16 | YoungPoong | 永丰 | Korea | 11.34 | 12.06 | 6.3% |

| 17 | Meiko | 名幸 | Japan | 10.82 | 11.17 | 3.2% |

| 18 | Fujikura | 藤仓 | Japan | 9.77 | 10.73 | 9.8% |

| 19 | Shinko | 新光电气 | Japan | 7.64 | 10.61 | 38.9% |

| 20 | LGInnotek | LG伊诺特 | Korea | 6.24 | 10.54 | 68.9% |

| 21 | KinwongElectronics | 景旺 | Mainland China | 9.17 | 10.23 | 11.6% |

| 22 | Simmtech | 信泰 | Korea | 8.58 | 10.18 | 18.6% |

| 23 | Flexium | 台郡 | Taiwan, China | 8.85 | 10.14 | 14.6% |

| 24 | Kinsus | 景硕 | Taiwan, China | 7.58 | 9.2 | 21.4% |

| 25 | Victory Giant | 胜宏 | China | 5.63 | 8.11 | 44.0% |

| 26 | GCE | 金像电子 | Taiwan, China | 6.45 | 7.94 | 23.1% |

| 27 | Daeduck Group | 大德 | Korea | 9.31 | 7.85 | -15.7% |

| 28 | TPT | 志超 | Taiwan, China | 7.36 | 7.75 | 5.3% |

| 29 | AKM+Meadville* | 安捷利 | China | 4.5 | 7.56 | 68.0% |

| 30 | CMK | 中央铭板 | Japan | 8.26 | 7 | -15.3% |

| 31 | Suntak | 崇达 | China | 5.4 | 6.33 | 17.2% |

| 32 | BHFlex' | 比艾奇 | Han | 569 | 6.11 | -98.9% |

| 33 | Shenzhen Fastprint | 兴森快捷 | China | 5.51 | 5.85 | 6.2% |

| 34 | Career | 嘉联益 | Taiwan, China | 5.58 | 5.44 | -2.5% |

| 35 | SYE | 生益电子 | China | 4.48 | 5.26 | 17.4% |

| 36 | Chin Poon | 敬鹏 | Taiwan, China | 6.07 | 5.2 | -14.3% |

| 37 | Kyocera | 京瓷 | Japan | 5 | 5.15 | 3.0% |

| 38 | Unitech | 耀华 | Taiwan, China | 7.61 | 4.88 | -35.9% |

| 39 | SumitomoDenko | 住友电工 | Japan | 5.74 | 4.73 | -17.6% |

| 40 | Murata | 村田 | Japan | 4.5 | 4.5 | 0.0% |

| 41 | KCE | Thailand | 3.74 | 4.46 | 19.3% | |

| 42 | Isu-Petasys | Korea | 4.44 | 4.36 | -1.8% | |

| 43 | Wuzhu | 五株 | China | 3.58 | 4.32 | 20.7% |

| 44 | NittoDenko' | 日东电工 | Japan | 4.33 | 4.29 | -0.9% |

| 45 | DYnamics | 定颖 | Taiwan, China | 4.65 | 4.28 | -8.0% |

| 46 | FounderPCB | 方正 | China | 4.4 | 4.24 | -3.6% |

| 47 | Aoshikang | 奥士康 | China | 3.3 | 4.22 | 27.9% |

| 48 | Bomin | 博敏 | China | 3 | 4.03 | 34.3% |

| 49 | APEX | 泰鼎 | Taiwan, China | 3.56 | 4.02 | 12.9% |

| 50 | SIFlex | Korea | 4.68 | 3.91 | -16.5% | |

| 51 | XiamenHon-Flex | 弘信 | China | 3.56 | 3.82 | 7.3% |

| 52 | Olympic | 世运 | Hong Kong, China | 3.45 | 3.82 | 10.7% |

| 53 | CCTC | 汕头超声 | China | 3.36 | 3.61 | 7.4% |

| 54 | GulTech | 高德 | Singapore | 3.16 | 3.61 | 14.2% |

| 55 | Ellington | 依顿 | Hong Kong, China | 4.36 | 3.55 | -18.6% |

| 56 | SunLynn | 深联电路 | China | 2.97 | 3.42 | 15.2% |

| 57 | Kyoden | Japan | 3.85 | 3.4 | -11.7% | |

| 58 | CEE | 中京 | China | 3.49 | 3.89 | 11.5% |

| 59 | ShowaDenko | 昭和电工 | Japan | 3.46 | 3.3 | -4.6% |

| 60 | Default | Default | ||||

| 61 | GuangzhouJunYa | 骏亚 | Hong Kong, China | 2.13 | 2.99 | 40.4% |

| 62 | Redboard | 红板 | Hong Kong, China | 3.11 | 2.96 | -4.8% |

| 63 | STEMCO | Korea | 2.34 | 2.89 | 23.5% | |

| 64 | Sanmina | 新美亚 | U.S.A | 2.8 | 2.85 | 1.8% |

| 65 | ASE | 日月光 | Taiwan, China | 2.62 | 2.82 | 7.6% |

| 66 | APCB | 竞国 | Taiwan, China | 2.69 | 2.82 | 4.8% |

| 67 | Chuanyi | 传艺科技 | China | 2.22 | 2.56 | 15.3% |

| 68 | DAP | Korea | 2.32 | 2.55 | 9.9% | |

| 69 | Fujitsu Interconnect | 富士通 | Japan | 2.43 | 2.44 | 0.4% |

| 70 | MFS | 维胜 | Singapore | 2.4 | 2.41 | 0.4% |

| 71 | Delton | 广合科技 | China | 1.93 | 2.35 | 21.8% |

| 72 | Kingshine | 科翔 | China | 1.92 | 2.32 | 20.8% |

| 73 | Kunshan Huaxing | 昆山华新 | China | 2 | 2.12 | 6.0% |

| 74 | ShiraiDenshi | 白井 | Japan | 2.45 | 2.09 | -14.7% |

| 75 | PalWonn | 竞华 | Taiwan, China | 2.4 | 2.07 | -13.8% |

| 76 | DaishoDenshi | 大昌 | Japan | 1.92 | 1.97 | 2.6% |

| 77 | Wuerth | 伍尔特 | Germany | 1.84 | 1.96 | 6.5% |

| 78 | Taihong | 台虹 | Taiwan, China | 1.57 | 1.92 | 22.3% |

| 79 | Circuitronix | 世科创力 | China | 1.8 | 1.9 | 5.6% |

| 80 | Ichia | 毅嘉 | Taiwan, China | 2.11 | 1.87 | -11.4% |

| 81 | Sunshine | 明阳科技 | China | 1.67 | 1.87 | 12.0% |

| 82 | Somacis | 森玛仕 | Italy | 1.8 | 1.8 | 0.0% |

| 83 | Onpress | 安柏 | Hong Kong, China | 1.81 | 1.78 | -1.7% |

| 84 | JianMankun | 满坤科技 | China | 1.56 | 1.78 | 14.1% |

| 85 | Huading | 华鼎 | China | 1.62 | 1.76 | 8.6% |

| 86 | LeaderTech | 上达 | China | 1.59 | 1.74 | 9.4% |

| 87 | Tigerbuilder | 悦虎 | China | 1.6 | 1.7 | 6.3% |

| 88 | OKI PCB Group | Japan | 1.55 | 1.68 | 8.4% | |

| 89 | LiangDar | 良达 | Taiwan, China | 1.71 | 1.65 | -3.5% |

| 90 | BYD | 比亚迪电子 | China | 1.63 | 1.63 | 0.0% |

| 91 | Kyosha | 京写 | Japan | 1.78 | 1.62 | -9.0% |

| 92 | ZLECircuits | 江西中络 | China | 1.43 | 1.57 | 9.8% |

| 93 | Jove | 深圳中富 | China | 1.62 | 1.57 | -3.1% |

| 94 | TLB | Korea | 1.26 | 1.56 | 23.8% | |

| 95 | Guangzhou GCl | 杰赛 | China | 1.38 | 1.52 | 10.1% |

| 96 | Toppan | 凸版印刷 | Japan | 1.3 | 1.5 | 15.4% |

| 97 | Brain Power | 欣强 | Taiwan, China | 1.36 | 1.46 | 7.4% |

| 98 | Amphenol | U.S.A | 1.4 | 1.45 | 3.6% | |

| 99 | Summit Interconnect | U.S.A | 1.2 | 1.45 | 20.8% | |

| 100 | CHPT | 中华精测 | Taiwan, China | 1.14 | 1.43 | 25.4% |

| 101 | Kunshan Wanzheng | 昆山万正 | China | 1.38 | 1.43 | 3.6% |

| 102 | SZXinyu | 新宇腾跃 | China | 1.03 | 1.35 | 31.1% |

| 103 | ACCESS | 越亚 | China | 0.68 | 1.33 | 95.6% |

| 104 | Suzhou Forewin--flex | 福莱盈 | China | 0.98 | 1.32 | 34.7% |

| 105 | Hyunwoo | Korea | 1.47 | 1.3 | -11.6% | |

| 106 | JiangsuSuhang | 苏杭 | China | 1.28 | 1.3 | 1.6% |

| 107 | SDG | 三德冠 | China | 1.03 | 1.28 | 24.3% |

| 108 | Aikokiki | 爱工 | Japan | 1.14 | 1.26 | 10.5% |

| 109 | NewFlex | Korea | 1.19 | 1.26 | 5.9% | |

| 110 | Schweizer | Germany | 1.46 | 1.26 | -13.7% | |

| 111 | Kingsun | 金顺 | China | 1.25 | 1.25 | 0.0% |

| 112 | Haihong | 常州海弘 | China | 1.22 | 1.23 | 0.8% |

| 113 | HaesungDS | Korea | 1 | 1.2 | 20.0% | |

| 114 | Yihao Circuit | 益豪 | China | 1.2 | 1.2 | 0.0% |

| 115 | KSG | Germany | 1.32 | 1.18 | -10.6% | |

| 116 | Huatao | 华涛 | China | 1.16 | 1.16 | 0.0% |

| 117 | DongguanHonyuen | 康源 | China | 1.06 | 1.16 | 9.4% |

| 118 | Difeida | 迪飞达 | China | 0.95 | 1.16 | 22.1% |

| 119 | JiangXiLianyi | 联益电子 | China | 1.1 | 1.15 | 4.5% |

| 120 | Plotech | 柏承 | Taiwan, China | 1.03 | 1.11 | 7.8% |

| 121 | Glorysky | 特创 | China | 0.95 | 1.09 | 14.7% |

| 122 | ShinAsashi | 新旭 | Japan | 105 | 1.08 | -99.0% |

| 123 | Yamamoto Mfg | 山本 | Japan | 103 | 1.06 | -99.0% |

| 124 | Camelot Electronic | 金禄 | China | 107 | 1.06 | -99.0% |

| 125 | Intronics | 英创力 | China | 0.94 | 1.03 | 9.6% |

| 126 | HT Electornics | 合通 | China | 1.03 | 1.03 | 0.0% |

| 127 | Star River | 星河 | China | 0.98 | 1.02 | 4.1% |

| 128 | BenlidaPCB | 奔力达 | China | 0.94 | 1 | 6.4% |

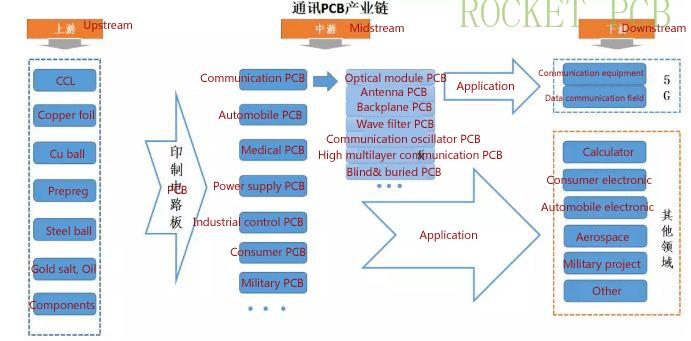

PCB, commonly known as the printed circuit board, is the mother of electronic system products, covering 5G, cloud computing, consumer electronics, automobile, military industry, aerospace, and so on.

The upstream of the PCB industry

Upstream of the industrial chain is PCB raw materials, including copper-clad plate, copper foil, copper ball, prepreg, and other base materials. Take Shennan circuit as an example, as a PCB manufacturer over the years, the cost of raw materials accounts for more than 40% of the operating revenue. Raw materials are the most important part of the gross profit space of PCB enterprises. Among the raw materials, the purchase of copper-clad laminate and prepreg accounts for about 50% of the cost of raw materials, which is the most direct upstream of PCB.

At present, in the field of copper-clad laminate, Kingboard group, which is listed in the Hong Kong stock market, ranks the first in the world, and Shengyi technology is the second. At present, the output value of CCL in mainland China has reached 65% of the world's output value, and the special copper clad laminate with high added value is monopolized by foreign factories such as Rogers, Taconic, and Panasonic.

The Midstream of the PCB industry

The midstream of the industrial chain, including various communication PCB, automobile PCB, medical PCB, industrial control PCB, military PCB, etc. Among them, communication PCB accounts for about 30% of the total PCB market.

Communication PCB can be subdivided into different types, including optical module, base station antenna, filter, vibrator board, etc. It is reported that in 2018, the market size of global communication PCB is 19. 065 billion US dollars, while the market share of base station PCB is 5-9 billion yuan, accounting for 5-10% of the total PCB output value.

The downstream of the PCB industry

At the downstream of the industrial chain, from the perspective of output value, PCB is currently the most widely used in the field of communication, computer (IDC), and other traditional electrical insulation systems. According to WECC data, in recent years, communication accounts for the largest proportion of PCB Applications, more than 30%.

In terms of incremental market, PCB output value in transportation (new energy vehicles, intelligent driving), medical and aerospace fields is also increasing.

According to Primark, from 2017 to 2022, communication and automotive electronics are expected to replace consumer electronics and become a new driving force for the global PCB industry, with cagr5 of 3. 66% and 6. 43% respectively.

According to N. T. Information statistics, there are about 2800 PCB factories in the world, of which 116 are worth more than 100 million US dollars, mainly distributed in the US, Japan, Korea, mainland China, and Taiwan.

The proportion of Chinese PCB enterprises

In China, the number of PCB enterprises is about 1500, among which 137 enterprises have a revenue of more than 100 million yuan. In terms of quantity allocation, there are 46 mainland China, accounting for 40% of the total, and 25 in Taiwan, accounting for 22% of the total. In terms of output value, the output value of the world's top 100 PCB Companies in 2017 was US $58. 18 billion. Among them, China's output value is 12 billion 384 million US dollars, accounting for 21. 3% of the total output value.

According to Primark data, the PCB output value of mainland China increased from 15 billion 37 million US dollars in 2008 to the US $29 billion 732 million in 2017 over the past 10 years, and the compound annual growth rate was 7. 87% (2. 21% of global CAGR), and the growth rate of mainland China was obviously higher than that of the whole world. And it is predicted that the compound annual growth rate of China will exceed 3. 7% in 2017-2022, while that of developed regions such as the United States, Japan, and Europe is only about 1%. Global PCB production capacity will be further concentrated in China.

Overall, in the next few years, the growth rate of the PCB market in China is only 3. 7%, which seems not fast, and the cake is not very big. However, with the explosion of the new communication and automobile cycle, it is expected to replace consumer electronics. For example, in the field of base station PCB segmentation, the market space in the 5G era may be more than 4 times higher than that in the 4G era, and this field is pregnant with very good investment opportunities.

The first year of 5G

In June last year, the Ministry of industry and information technology of the People's Republic of China officially issued a commercial license, marking that 5G construction was six months ahead of schedule. Therefore, this year is also known as the first year of 5G. Compared with 4G, 5G has three obvious characteristics: low delay, high reliability, and high density. Just like this, in the field of base station PCB, there is a change of "quantity and price rise".

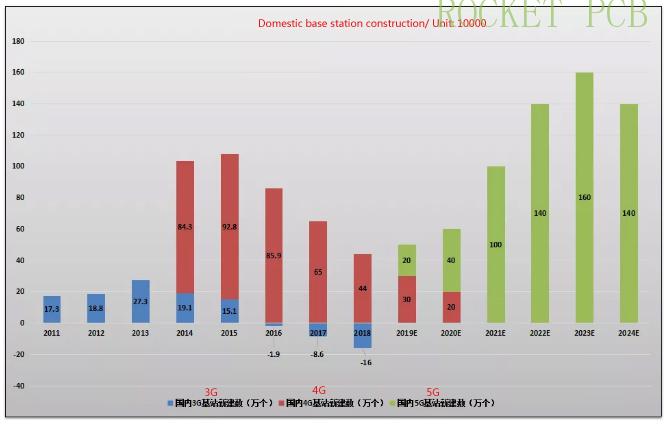

First, the number of base stations has increased

According to the data published by domestic operators, the total number of 4G base stations in 2017 was 3. 28 million, and the new increment in the peak period of construction in 2014 / 2015 was close to 1 million / year. The number of new 4G base stations will gradually decrease in the next two years when the total number of 4G base stations will be close to 4 million.

According to the calculation, 5G base stations in China will be 1. 2-1. 5 times of 4G base stations, and more small base stations will be equipped. It is predicted that the new increment of 5G Hongji station in 2023 will be 1. 5 times the peak of 4G construction in 2015.

Second, the technical difficulty and PCB price are increased

5G requires higher and higher integration density on the circuit board, which has higher requirements on the number of layers, area, drilling accuracy, wiring, etc. of the PCB. In addition, the application proportion of high-frequency and high-speed materials is expected to significantly increase the unit price of PCB products.

The use of PCB for a single 5G base station is about 3. 21 ㎡, which is 1. 76 times that of a 4G base station (1. 825 ㎡). At the same time, due to the higher frequency of 5G communication and the greater demand for PCB performance, the unit price of PCB for a 5G base station is higher than that for a 4G base station. In general, the value of a single PCB in the 5G era is about three times that of 4G.

Roughly, the market size of PCB in the 5G era will be more than four times that of 4G. The incremental cake is very big, and the leading enterprises in it will fully benefit.

Rocket PCB is able to closely integrate manufacturing, logistics, and PCB supply chain management. As a result, design, assembly, and product distribution can be done faster at a lower cost and without compromising our high-quality standards. We always put the best interests first when providing innovative solutions for manufacturing customers’ products. Welcome any kind of PCB orders, we will serve you wholeheartedly! Contact us at sales@rocket-pcb.com.