What is the market development prospect of PCB flex-rigid board in 2025?

According to market research data, the global Rigid-Flex PCB market is expected to grow at a compound annual growth rate of 10%-12% from 2023 to 2030, and the market size will grow from billions of dollars to a larger range.

The Asia-Pacific region (especially China, Japan, and South Korea) is the world's largest market, mainly due to the rapid growth of consumer electronics and the automotive industry.

After withdrawing from the HDI market at the end of 2019, only one year later, the news that Samsung Electro-Mechanics will withdraw from the rigid-flexible board (RFPCB) market has become increasingly popular. 2021 South Korean media TheElec reported that Samsung Electro-Mechanics announced on October 15 that it would terminate its flexible printed circuit board (RFPCB) business. Previously, the company had been producing such products in its factory in Vietnam.

In the era of the Internet of Everything driven by 5G, HDI and RFPCB, as two relatively advanced products in the PCB industry, have seen growing market demand in recent years. "As more and more manufacturers enter this field, intensified competition leads to the rampant low-price strategy, and the profit margins of leading manufacturers are constantly compressed. When profitability declines, giant manufacturers are forced to leave the market." Industry insiders said.

In contrast, the types of consumer electronics are becoming more and more diversified, and the demand for segmented application fields is growing. Domestic PCB manufacturers also see opportunities in their layout.

Giants leave the market

Recently, Samsung Electro-Mechanics has withdrawn from the soft-hard combination board market. The industry predicts that more giants may withdraw from the market in the future.

It is reported that Samsung Electro-Mechanics RFPCB is mainly used for OLED panels produced by its related company Samsung Display. These OLED panels are adopted by Samsung Electronics, Apple, and Chinese smartphone manufacturers. Currently, Samsung Display RFPCB suppliers include Samsung Electro-Mechanics, BH, YP Electronics, Interflex, and Xinxing.

However, RFPCB brings about US$362 million in revenue to Samsung Electro-Mechanics each year, but due to declining profits, Samsung Electro-Mechanics has begun to withdraw.

It is worth noting that in 2018, Samsung Electro-Mechanics decided to close its HDI factory in Kunshan, China, and officially withdrew from the high-density interconnect board (HDI, high-density PCB) market.

It is understood that Korean brands have a high demand for hard-flex boards, which has led Korean PCB manufacturers such as Samsung Electro-Mechanics and BH Flex to invest relatively concentratedly and advanced in the field of hard-flex boards, but they also mainly serve the needs of their own brands.

However, in recent years, the demand for hard-flex boards from non-Korean manufacturers has also begun to grow, and the supply system of Taiwanese and Chinese manufacturers has gradually improved, and the production capacity has gradually expanded, gradually extending from battery modules, mobile phone lens modules, etc. to automotive electronics ADAS lens modules and other component modules. It is not easy for Korean manufacturers to obtain non-Korean orders.

At the same time, price wars are also one of the influencing factors. "RFPCB is one of the three major sectors of Samsung Electro-Mechanics' PCB business. After withdrawing from the HDI market last year, abandoning the RFPCB business is also a helpless move, and the decline in profitability is a hard injury. Finally, the remaining packaging substrates of the PCB business are also expanding the domestic mobile phone brands of OLED displays, trying to improve profitability." Industry insiders said.

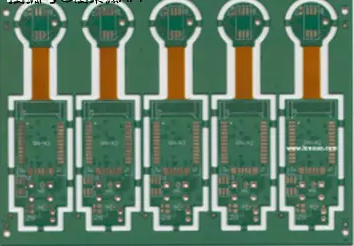

"Where there is a market, there is competition, and where there is competition, there is lethality." When the giants left, domestic manufacturers saw more opportunities. Under market demand, many manufacturers that entered or expanded production in recent years also rushed to enter the market. The birth and development of FPC and PCB gave birth to the soft and hard combination board, a circuit board that has both FPC and PCB characteristics. At that time, the AirPods released by Apple led the trend of wireless Bluetooth headsets. As the mainstream technology used by AirPods, the hard and soft combination board has benefited Taiwan-based supply chain manufacturers such as Xinxing, Huatong, and Yaohua. When the second generation of AirPods was released, it also led the hard and soft combination board technology to a peak. However, the good times did not last long. At the end of 2019, Apple's high-end AirPods Pro products changed from hard and soft combination boards to SiP plus soft board solutions, which gradually made the hard and soft combination board lose its stage in the TWS products with the highest market share. At the same time, an industry insider revealed: "Apple may abandon the hard-and-soft board and switch to SiP solution in its new iPhone in 2021."

Now, as Apple's technology route continues to upgrade and gradually abandon the hard-and-soft board, the domestic PCB market is driven by the application of lens modules, TWS headphones, wearable devices, automotive electronics and other fields, and the penetration rate of hard-and-soft boards continues to deepen.

Admittedly, as a weathervane in the smartphone industry, Apple is relatively at the forefront of technological innovation. Benefiting from the demand for multi-lens modules for mobile phones, hard-and-soft boards have become one of the technologies with the strongest growth momentum in 2019. With the gradual expansion of subdivided application fields, it has also attracted the layout of some small manufacturers in Taiwan and mainland manufacturers.

Looking at domestic PCB manufacturers, Hongxin Electronics began to add weight to the field of hard-and-soft boards last year. Its first phase project has been successfully put into production. After the project is fully completed, it is expected that the annual output of hard-and-soft boards will reach 440,000 square meters and the annual output value will reach 2 billion yuan.

At the same time, Bomin Electronics is also expanding its production on a large scale. Its production projects include HDI and rigid-flex boards. After the project is completed and expanded, it is expected to produce 120,000 square meters of rigid-flex boards annually.