PRODUCTS

ttm technologies (ttmi) stock receives price target hike at canaccord genuity

by:Rocket PCB

2019-11-01

NEW YORK (TheStreet)--

TTM technology (TTMI -Get Report)

As the company reiterated its \"buy\" rating, analysts at Canaccord Genuity raised their share price target from $11 to $12. The California-

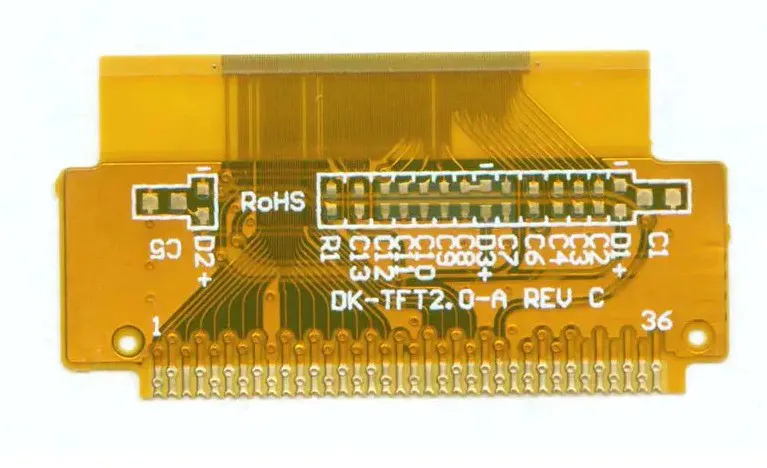

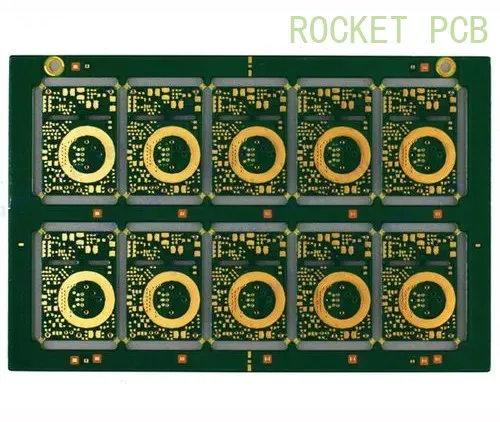

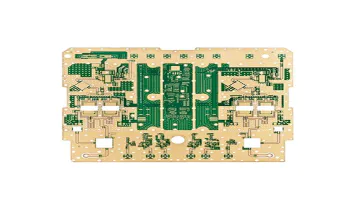

Headquartered around the world, it offers a wide range of printed circuit board products and back panel components.

Prior to this, the company announced yesterday to complete the acquisition of Viasystems Group (VIAS)

Board manufacturer for electronic equipment.

According to analysts, TTM Technologies completed the acquisition of rival companies for more than $0. 38 billion.

The acquisition is \"very complementary and will make the combined company a leading PCB manufacturer, vias\'s strength in the automotive, medical, industrial and instrumental fields complements TTMI\'s analysts in the smartphone space: \"networking and communications, medical and industrial, military and aerospace. \".

Shares rose 0 in early trading on Tuesday. 99% to $10. 17.

In addition, the street rating team rated ttm technologies Inc. as a Hold with a rating of C.

For their advice, the street rating team has the following statement: \"We are talking about ttm technologies Inc . (TTMI)a HOLD.

The main factors that affect our rating are mixed, some show strength, some show weakness, and there is little evidence that this stock is justified in relation to the positive or negative performance of most other stocks.

The company\'s strengths are reflected in multiple areas such as revenue growth, strong net income growth and good operating cash flow.

However, contrary to these advantages, we find that the overall profit margin of the company has been very poor.

TTM technology (TTMI -Get Report)

As the company reiterated its \"buy\" rating, analysts at Canaccord Genuity raised their share price target from $11 to $12. The California-

Headquartered around the world, it offers a wide range of printed circuit board products and back panel components.

Prior to this, the company announced yesterday to complete the acquisition of Viasystems Group (VIAS)

Board manufacturer for electronic equipment.

According to analysts, TTM Technologies completed the acquisition of rival companies for more than $0. 38 billion.

The acquisition is \"very complementary and will make the combined company a leading PCB manufacturer, vias\'s strength in the automotive, medical, industrial and instrumental fields complements TTMI\'s analysts in the smartphone space: \"networking and communications, medical and industrial, military and aerospace. \".

Shares rose 0 in early trading on Tuesday. 99% to $10. 17.

In addition, the street rating team rated ttm technologies Inc. as a Hold with a rating of C.

For their advice, the street rating team has the following statement: \"We are talking about ttm technologies Inc . (TTMI)a HOLD.

The main factors that affect our rating are mixed, some show strength, some show weakness, and there is little evidence that this stock is justified in relation to the positive or negative performance of most other stocks.

The company\'s strengths are reflected in multiple areas such as revenue growth, strong net income growth and good operating cash flow.

However, contrary to these advantages, we find that the overall profit margin of the company has been very poor.

Custom message

Related Products