PCB industry declines in 2023, IC substrate growth rate declines first and then rises

PCB industry declines in 2023, IC substrate growth rate declines first and then rises

PCB companies are in the development of tens of billions of high-speed growth periods, the future potential is huge.

As the mother of all electronic products, the PCB industry is also experiencing a small decline in market size due to poor terminal market conditions. Fortunately, the PCB market will resume year-on-year growth from 2024 onwards, with IC substrates, as the key substrate for advanced packaging of integrated circuits, leading the growth rate in the next five years.

According to Prismark's forecast, the global PCB output value will be $78.367 billion in 2023, down 4.13% from $81.741 billion in 2022, but will resume year-on-year growth from 2024 onwards, with a CAGR of 3.8% from 2023 to 2027.

As for product line categories, in 2023, the PCB industry includes multilayer PCB, flexible PCB + modules, HDI PCB, and IC substrates, and the output value of these four major product lines will decline across the board. Among them, the output value of RPCB multilayers ranks first, reaching $37.34 billion, a decline of 3.57% from 2022; the output value of IC substrates reaches $16.073 billion, a decline of 7.71% from 2022, the largest decline; the output value of flexible boards+modules reaches $13.427 billion, a decline of 3% from the previous year; and the output value of HDI reaches $11.528 billion, a decline of 2% from the previous year.

2023-2027 Global PCB Market Size Estimate (US$ 100 million) | ||||

Year | RPCB | Flex PCB+module | HDI | IC substrates |

2022 (E) | 387.21 | 138.42 | 117.63 | 174.15 |

2023 (F) | 373.4 | 134.27 | 115.28 | 160.73 |

2024 (F) | 381.79 | 141.31 | 122.25 | 174.41 |

2025 (F) | 419.39 | 148.72 | 129.65 | 189.26 |

2026 (F) | 444.3 | 156.52 | 137.49 | 205.38 |

2027 (F) | 450.48 | 164.73 | 145.81 | 222.86 |

2022-2023 CAGR | 3.10% | 3.50% | 4.40% | 5.10% |

Data sources: Prismark | ||||

Despite the recession in 2023, the market generally expects that the market will stabilize and demand will gradually recover in the second half of 2023 or 2024. Prismark's estimated data also shows that the whole line will resume positive growth from 2024. The average annual compound growth rate of the four product lines from 2023 to 2027 is 3.1%, 3.5%, 4.4% and 5.1% respectively.

It is not difficult to find that IC substrates, as key substrates for advanced packaging of integrated circuits, have potential growth space.

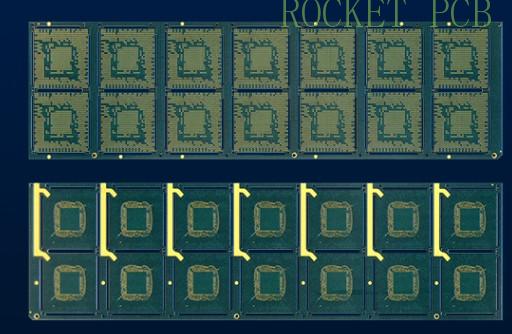

The IC substrate is developed on the basis of the related technology of the PCB board, which is used to establish the signal connection between the IC and the PCB. In addition, it can also play the role of protecting the circuit, fixing the circuit and dissipating the waste heat. It has the characteristics of high density, high precision, miniaturization and thinness: In the field of high-end packaging, IC substrates have replaced traditional lead frames and become an indispensable part of chip packaging, not only providing support, heat dissipation and protection for chips; At the same time, it provides an electronic connection between the chip and the PCB motherboard, which plays a role of "bridge between the top and the bottom".

According to analysis, the IC substrate industry has experienced rapid growth in the past few years, but this year's poor demand has led to a significant decline this year. With the market demand expected to pick up in 2024, IC substrates may usher in new opportunities.

The market pattern of IC substrate was first led by Japanese manufacturers, and then the production capacity was partially transferred to China Taiwan and South Korea along with the semiconductor industry chain. In recent years, due to the impact of Korean and China Taiwan manufacturers, Japanese companies have withdrawn from the low-end market and switched to high-end packaging substrates such as FC BGA and FC CSP. At present, the top three IC substrate enterprises are Unimicron Electronics, Ibiden and Simmtech, accounting for 15%,11% and 10% market share respectively.

On the whole, the product series of Taiwan enterprises in China is more comprehensive, while the mainland enterprises in China are still concentrated in the entry-level and general categories, and are actively introducing high-end series products. According to incomplete statistics, the Chinese local PCB enterprises that have laid out the IC substrate business include (in no particular order): FastPrint, Shennan Circuit, Zhuhai Access, Kingwong Electronics, Suntak, Bomin Electronics, Kingshine Stock, China Eagle Electronic, Dongshan Precision, etc.

In the past two decades, the overall trend of China's PCB industry development is basically the same as that of the global PCB industry. Under the overall trend of the global PCB industry shifting to Asia, benefiting from the advantages of huge domestic demand market space, relatively low labor costs, industrial policy support, and mature industrial processing technology, mainland of China attracted many PCB companies to invest.

On the one hand, a large number of foreign-funded enterprises to mainland of China transfer or new capacity, on the other hand, mainland domestic enterprises to accelerate the expansion of production capacity, Mainland China has become the world's largest PCB industry base, accounting for more than 50% of the global market share.

The sustainable and healthy development of China's PCB industry has a significant impact on the global PCB industry and the development of the global electronic information industry.

China has formed the Pearl River Delta region, and Yangtze River Delta region as the core area of the PCB industry cluster. According to CPCA statistics, in 2019, the PCB industry was distributed in 22 provinces and municipalities directly under the Central Government, with a total of 2,372 enterprises, including 1,437 PCB enterprises in Guangdong Province, accounting for 60.58%; There are 341 PCB enterprises in Jiangsu Province, accounting for 14.38%; There are 108 PCB enterprises in Zhejiang Province, accounting for 4.55%. Guangdong, Jiangsu, Zhejiang, Shanghai, Fujian and other coastal areas of PCB enterprises accounted for more than 84% of the total number of PCB manufacturers.

In recent years, with the rising labor costs in coastal areas and the improvement of environmental protection requirements, some PCB enterprises began to migrate their production capacity to provinces and cities with better industrial conditions in the central and western regions, such as Jiangxi, Hubei, Hunan, Sichuan, etc., which may form the Pearl River Delta in the future.

China is the world's largest manufacturing base and consumer market for electronic information products. With the continuous promotion of "Made in China 2025", a number of world-renowned local enterprises have emerged in emerging markets such as mobile Internet, Internet of Things, big data, cloud computing, artificial intelligence and driverless cars, providing more development opportunities for supporting the electronic manufacturing industry. Under the guidance of the national supply-side structural reform and innovation-driven development strategy, the electronic information manufacturing industry accelerated the structural adjustment and the industrial prosperity continued to boost. As one of the three pillar industries of the electronics industry, PCB is closely related to the overall development of the electronic information industry. Domestic PCB enterprises fully benefit from the policy dividend, constantly improve their product lines while timely docking with the capital market, through industrial optimization and upgrading, to the international first-class manufacturers.