PRODUCTS

buying magnuson and its problems

by:Rocket PCB

2019-10-21

Special report by the New York Times.

1981 this is a digital version of an article from The Times Print Archive, before it starts online in 1996.

To keep these articles as they appear initially, the Times will not change, edit, or update them.

There are occasional copywriting errors or other problems during the digitization process.

Please send a report of such issues to archid_feedback @ nytimes. com.

Storage technology companies may get the product it is looking for when they acquire Magnuson Computer Systems.

But it will also buy a company that has been losing money, its employees and its reputation.

Storage technology company, a manufacturer of computer data storage equipment located in the city of Wisconsin, Colo.

Agreed in principle on December.

About $73 million in stock acquisition of Magnuson

According to the share price at the time of the announcement, Magnuson shareholders will receive Magnuson\'s share of storage technology worth $13 per share.

For storage technology, the acquisition will achieve its goal of gaining a foothold in the computer market compatible with computers produced by international commercial machines.

Magnuson medium production

Large computer that can be used with I. B. M. equipment.

Trying to be a \"mini\"I. B. M.

Jesse Aweida, president and chairman of storage technology, said the acquisition would enable his company to \"provide all systems and peripherals to the intermediate computer system market \",I. B. M.

Buying an ad for Magnuson is not the first attempt at storage technology in Silicon Valley, California.

The company has twice tried to acquire Memorex, which was recently acquired by Burroughs.

At 1980, it announced a merger with Amdahl, which made I. B. M. -

Large, compatible computers fail.

By acquiring Magnuson, storage technology has greatly accelerated its entry into the market.

But it also brings a lot of problems.

A year ago, despite the difficult task of competing with me, analysts believed that Magnuson could succeed alone. B. M.

In January 1977, the founder of Magnuson received $400,000 from private investors and quickly built a prototype computer.

The $4 million capital injection from the company is helping with manufacturing.

Robert McCullough recalled that sales below the project \"We talked about $100 million in sales a few years later,\" who, like the other three founders, had left Magnuson.

In the first nine months of this year, the company reported only $24.

Income is 5 million.

In June 1980, the company went public and sold millions of shares for $20 a share.

As of December, the company\'s share price had soared to $46, while the company\'s annual share price was $27.

Sales were 8 million and profits were $ 160%.

5 million, the company first.

In early 1981, a survey of computer users showed that Magnuson was ranked first.

1 customer satisfaction.

Its computer has won praise for its modular structure, making it easier to upgrade to a more powerful model.

Please click on the box to verify that you are not a robot.

The email address is invalid. Please re-enter.

You must select the newsletter you want to subscribe.

View all New York Times newsletters.

But since then, according to Robert Sullivan, analysts at Penn, Weber, Jackson and Curtis

Due to extensive management and marketing changes, the company has experienced a lot of turbulence and started

Problems and problems with components.

Before the acquisition of storage technology, Magnuson\'s share price was around $10.

Friday is over-the-

$11 counter market.

Bid 75, up 1/2 cents.

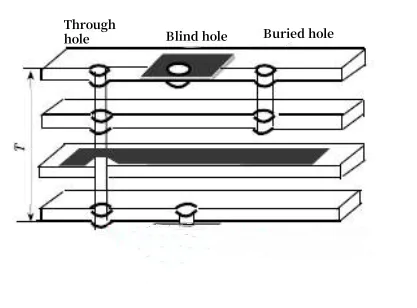

The manufacture of the new models will be shipped in the first quarter of this year, but the manufacture of these models has been hindered due to test equipment failure, incorrect print board size and generally slow assembly operations.

Even if they arrive at the scene, there is a problem with the system.

In the third quarter, the company shipped about 40 new systems, bringing the number of Magnuson computers installed to 350.

Key employees have left several key employees this year. And on Nov.

13, previously announced a loss of $3 in the first nine months.

4 million, Magnuson fired 10% of the labor force, about 65.

President Joseph Hitt said that in addition to the loss of money, time and staff, the company has lost more serious things.

\"It is generally believed that we have lost credibility,\" he said . \"

But he added in an interview before announcing the merger that I think we will get it back.

James Barth, chief financial officer, expects Magnuson to grow at an annual rate of more than 20%, higher than the overall growth rate of the $4 billion market. Mr. advertising

Hitt cited a series of achievements, including a comprehensive reform of the company\'s management team.

In addition, Sir.

Hitt has developed guidelines to avoid conflicts between engineers and marketers.

Finally, in addition to the high manufacturing and marketing costs, Magnuson\'s profitability is under new pressure.

In August, the company announced that it would launch a major research project to develop computers based on large computers.

Scale integrated circuits, funded by a separate limited partnership. Then in mid-

In October, the company stated that it was aware of the accounting rules that made the practice unsatisfactory.

Instead, 20 people working on this project will be paid by Magnuson.

Uncertainty in Magnuson has led analysts to lower their earnings expectations.

Smith Barney Harris Urben\'s Peter Rabe has reduced his income estimates twice, and among analysts, these estimates are within 1982 of the break time

$1 per share.

However, some analysts are optimistic about the future.

It is estimated that Magnuson has at least $20 per share. L.

Duane Kirkpatrick in San Francisco with Robertson, Coleman, Stephens and Woodman said, \"I am very surprised at the $13 bid \".

\"They must know something they didn\'t tell people.

Given that we are led to believe that the company has the potential, this is actually a giveaway price.

\"A version of this article appears on page D00001, country edition, December 21, 1981, with the title: Purchase of MAGNUSON and its issues.

1981 this is a digital version of an article from The Times Print Archive, before it starts online in 1996.

To keep these articles as they appear initially, the Times will not change, edit, or update them.

There are occasional copywriting errors or other problems during the digitization process.

Please send a report of such issues to archid_feedback @ nytimes. com.

Storage technology companies may get the product it is looking for when they acquire Magnuson Computer Systems.

But it will also buy a company that has been losing money, its employees and its reputation.

Storage technology company, a manufacturer of computer data storage equipment located in the city of Wisconsin, Colo.

Agreed in principle on December.

About $73 million in stock acquisition of Magnuson

According to the share price at the time of the announcement, Magnuson shareholders will receive Magnuson\'s share of storage technology worth $13 per share.

For storage technology, the acquisition will achieve its goal of gaining a foothold in the computer market compatible with computers produced by international commercial machines.

Magnuson medium production

Large computer that can be used with I. B. M. equipment.

Trying to be a \"mini\"I. B. M.

Jesse Aweida, president and chairman of storage technology, said the acquisition would enable his company to \"provide all systems and peripherals to the intermediate computer system market \",I. B. M.

Buying an ad for Magnuson is not the first attempt at storage technology in Silicon Valley, California.

The company has twice tried to acquire Memorex, which was recently acquired by Burroughs.

At 1980, it announced a merger with Amdahl, which made I. B. M. -

Large, compatible computers fail.

By acquiring Magnuson, storage technology has greatly accelerated its entry into the market.

But it also brings a lot of problems.

A year ago, despite the difficult task of competing with me, analysts believed that Magnuson could succeed alone. B. M.

In January 1977, the founder of Magnuson received $400,000 from private investors and quickly built a prototype computer.

The $4 million capital injection from the company is helping with manufacturing.

Robert McCullough recalled that sales below the project \"We talked about $100 million in sales a few years later,\" who, like the other three founders, had left Magnuson.

In the first nine months of this year, the company reported only $24.

Income is 5 million.

In June 1980, the company went public and sold millions of shares for $20 a share.

As of December, the company\'s share price had soared to $46, while the company\'s annual share price was $27.

Sales were 8 million and profits were $ 160%.

5 million, the company first.

In early 1981, a survey of computer users showed that Magnuson was ranked first.

1 customer satisfaction.

Its computer has won praise for its modular structure, making it easier to upgrade to a more powerful model.

Please click on the box to verify that you are not a robot.

The email address is invalid. Please re-enter.

You must select the newsletter you want to subscribe.

View all New York Times newsletters.

But since then, according to Robert Sullivan, analysts at Penn, Weber, Jackson and Curtis

Due to extensive management and marketing changes, the company has experienced a lot of turbulence and started

Problems and problems with components.

Before the acquisition of storage technology, Magnuson\'s share price was around $10.

Friday is over-the-

$11 counter market.

Bid 75, up 1/2 cents.

The manufacture of the new models will be shipped in the first quarter of this year, but the manufacture of these models has been hindered due to test equipment failure, incorrect print board size and generally slow assembly operations.

Even if they arrive at the scene, there is a problem with the system.

In the third quarter, the company shipped about 40 new systems, bringing the number of Magnuson computers installed to 350.

Key employees have left several key employees this year. And on Nov.

13, previously announced a loss of $3 in the first nine months.

4 million, Magnuson fired 10% of the labor force, about 65.

President Joseph Hitt said that in addition to the loss of money, time and staff, the company has lost more serious things.

\"It is generally believed that we have lost credibility,\" he said . \"

But he added in an interview before announcing the merger that I think we will get it back.

James Barth, chief financial officer, expects Magnuson to grow at an annual rate of more than 20%, higher than the overall growth rate of the $4 billion market. Mr. advertising

Hitt cited a series of achievements, including a comprehensive reform of the company\'s management team.

In addition, Sir.

Hitt has developed guidelines to avoid conflicts between engineers and marketers.

Finally, in addition to the high manufacturing and marketing costs, Magnuson\'s profitability is under new pressure.

In August, the company announced that it would launch a major research project to develop computers based on large computers.

Scale integrated circuits, funded by a separate limited partnership. Then in mid-

In October, the company stated that it was aware of the accounting rules that made the practice unsatisfactory.

Instead, 20 people working on this project will be paid by Magnuson.

Uncertainty in Magnuson has led analysts to lower their earnings expectations.

Smith Barney Harris Urben\'s Peter Rabe has reduced his income estimates twice, and among analysts, these estimates are within 1982 of the break time

$1 per share.

However, some analysts are optimistic about the future.

It is estimated that Magnuson has at least $20 per share. L.

Duane Kirkpatrick in San Francisco with Robertson, Coleman, Stephens and Woodman said, \"I am very surprised at the $13 bid \".

\"They must know something they didn\'t tell people.

Given that we are led to believe that the company has the potential, this is actually a giveaway price.

\"A version of this article appears on page D00001, country edition, December 21, 1981, with the title: Purchase of MAGNUSON and its issues.

Custom message