PRODUCTS

ttm technologies buys viasystems for $927m to combine circuit board makers

by:Rocket PCB

2019-09-22

NEW YORK (The Deal)--

TTM technology (TTMI -Get Report)

Monday said it would acquire Viasystems (VIAS)

For $0. 927 billion in cash, stocks and hypothetical debt trading, two board manufacturers who use electronic equipment are merged together.

Terms of trade in Costa Mesa, California-

Pay $11 based on TTM.

Cash 33,0.

Its 706 per share of Viasystems costs $16.

$46 per share, a premium of 40% over $11. Close 70 on Friday

The equity value of Viasystems is about $0. 368 billion, and TTM also takes on the debt of the target company. St. Louis-

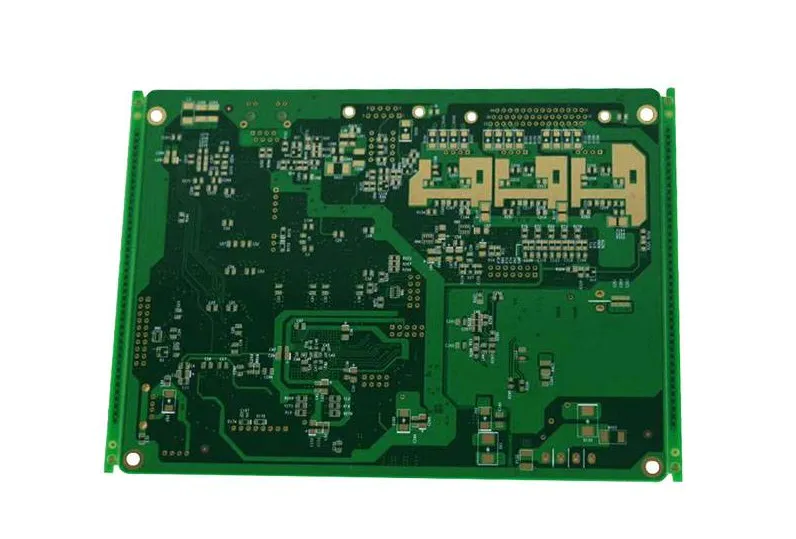

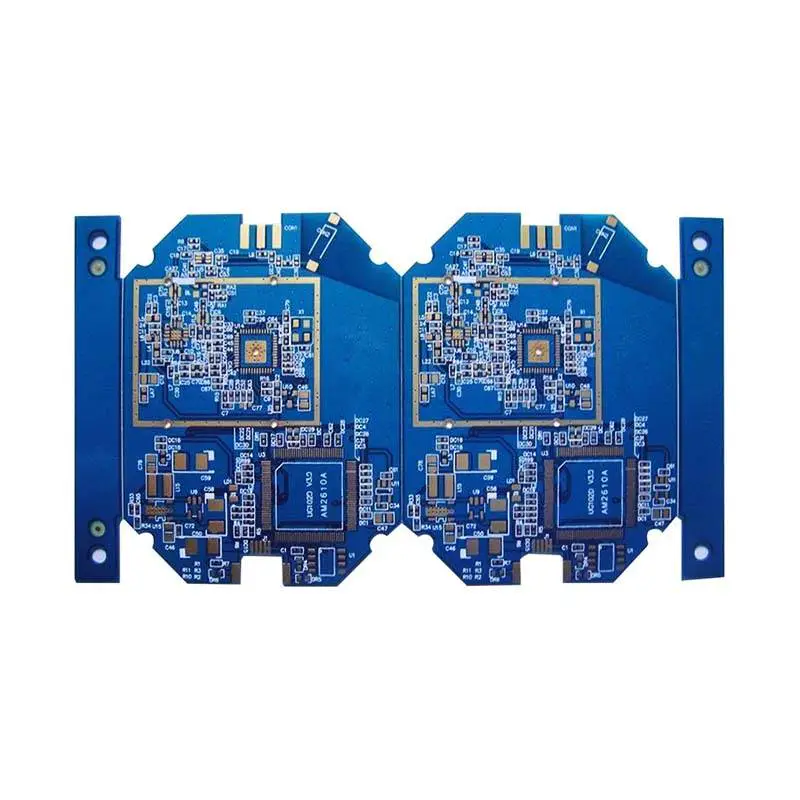

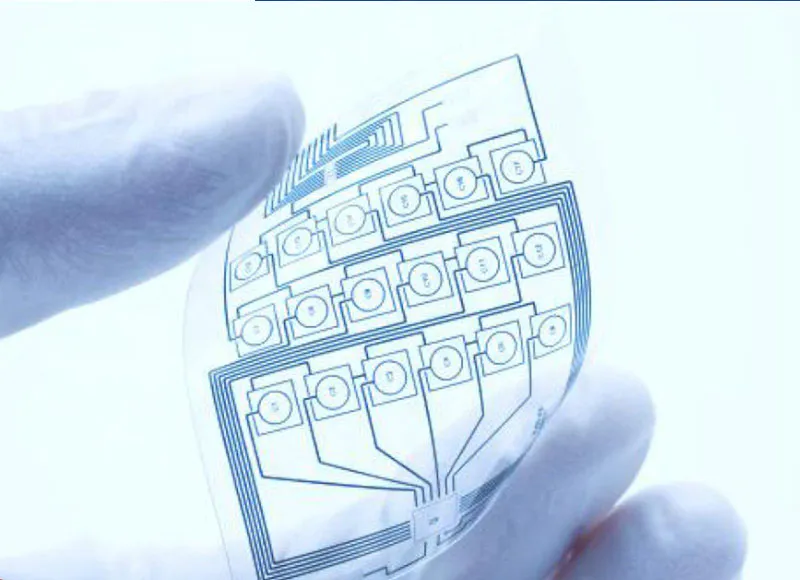

Viasystems is a company that produces circuit boards and related equipment for the automotive, aerospace, industrial and communications markets with over 14,800 employees worldwide.

The combination will become one of the world\'s largest manufacturers of printed circuit boards, with 28 factories worldwide employing about 30,000 employees, TTM said.

The deal pushed TTM into the automotive sector and expanded its business elsewhere.

This combination will generate an estimated Ebitda of $0. 3 billion with an income of $2.

For the 12 months ended June 30, 2014, it was 5 billion per cent.

Edman, TTM chief executive, said in a statement: \"This combination creates an industry leader that delivers expanded capabilities from a broad global footprint to serving more customers and end markets

\"Next, we will accelerate our strategy to diversify our business and reduce the seasonal impact inherent in the mobile terminal market.

\"TTM says it has identified at least $25 million in cuts that are expected to be achieved in the first year.

The company said it had received

Written financing commitment by JPMorgan Chase

Barclays said it expects to use the new $1.

3 billion high-level secured credit financing, financing the cash portion of the transaction, refinancing the debt and providing post-financingdeal liquidity.

Viasystems filed for bankruptcy in 2002 and appeared a year later.

Most companies-

Owned by HM Capital Partners LLC and Black Diamond Capital Management LLC, when it acquired Merix Corp. in 2009, the company went public through backdoor listings.

The company added DDi.

Cash for 2012 was $0. 282 billion.

David M, CEO of Viasystems

Sindelar said in a statement that the TTM transaction \"is an excellent opportunity to realize value for shareholders, creating new opportunities for our customers and employees.

\"JPMorgan has worked as a financial advisor to TTM with Stiffel, Nicolaus & Co.

Advise Viasystems.

TTM technology (TTMI -Get Report)

Monday said it would acquire Viasystems (VIAS)

For $0. 927 billion in cash, stocks and hypothetical debt trading, two board manufacturers who use electronic equipment are merged together.

Terms of trade in Costa Mesa, California-

Pay $11 based on TTM.

Cash 33,0.

Its 706 per share of Viasystems costs $16.

$46 per share, a premium of 40% over $11. Close 70 on Friday

The equity value of Viasystems is about $0. 368 billion, and TTM also takes on the debt of the target company. St. Louis-

Viasystems is a company that produces circuit boards and related equipment for the automotive, aerospace, industrial and communications markets with over 14,800 employees worldwide.

The combination will become one of the world\'s largest manufacturers of printed circuit boards, with 28 factories worldwide employing about 30,000 employees, TTM said.

The deal pushed TTM into the automotive sector and expanded its business elsewhere.

This combination will generate an estimated Ebitda of $0. 3 billion with an income of $2.

For the 12 months ended June 30, 2014, it was 5 billion per cent.

Edman, TTM chief executive, said in a statement: \"This combination creates an industry leader that delivers expanded capabilities from a broad global footprint to serving more customers and end markets

\"Next, we will accelerate our strategy to diversify our business and reduce the seasonal impact inherent in the mobile terminal market.

\"TTM says it has identified at least $25 million in cuts that are expected to be achieved in the first year.

The company said it had received

Written financing commitment by JPMorgan Chase

Barclays said it expects to use the new $1.

3 billion high-level secured credit financing, financing the cash portion of the transaction, refinancing the debt and providing post-financingdeal liquidity.

Viasystems filed for bankruptcy in 2002 and appeared a year later.

Most companies-

Owned by HM Capital Partners LLC and Black Diamond Capital Management LLC, when it acquired Merix Corp. in 2009, the company went public through backdoor listings.

The company added DDi.

Cash for 2012 was $0. 282 billion.

David M, CEO of Viasystems

Sindelar said in a statement that the TTM transaction \"is an excellent opportunity to realize value for shareholders, creating new opportunities for our customers and employees.

\"JPMorgan has worked as a financial advisor to TTM with Stiffel, Nicolaus & Co.

Advise Viasystems.

Custom message

Related Products