PRODUCTS

bodycote acquisitions turn up heat

by:Rocket PCB

2019-10-16

Bodycote International and its chairman, Joe Dwek, are the remnants of two more successful diseases

Doomed to 1970 of the Slater Walker Empire

Most of their wealth is attributed to the management team led by chief executive John Chesworth, who successfully re-established

Designed the team in the past 18 years or so.

The last of the original textile rights-a bullet-

Manufacturer of bulletproof clothes-

Sold out earlier this month, through a series of acquisitions, Mr Chesworth created one of Britain\'s largest independent metal heat treatment groups.

This helps it show pre-yesterday-

The tax profit reached £ 27. 6m for 1996.

If the analyst\'s forecast for £ 46 this year is correct, the figure will increase by more than 10 times in 11 years.

It will take time for the market to recognize these achievements, however, after 32 years.

Yesterday, 5 P rose to 770 p, and the share price was almost twice as high as 18 months ago, a forward multiple of 19.

This exciting rating is usually awarded to a company that is in the leading position in technology, but Mr Chesworth is the first company to acknowledge that his rating is neither high rated

A technical or expensive production line that describes Bodycote as a factory rental business that sells time on a stove.

But it turns out that its equipment is more efficient and reliable than other devices.

A large amount of capital investment will be twice that of £ 37.

6 m this year, helping Bodycote to take a large share of the market for other manufacturer components in each industry, from aerospace to electric hand tools, gives them hardness and durability.

There is still a lot to do.

Bodycote estimates its share of the UK outsourcing market is less than £ 100, compared to three

Quarterly heat treatment work is still underwayhouse.

Although Mr Chesworth\'s description is modest, there is still some pretty funky business in Bodycote.

Its dominant position in thermal equilibrium processing makes it

Integrity Applications like aeroengine blades.

The prospects for the group\'s sales in the current booming aerospace industry are fair, while the addition of the car business looks reasonable, at least in the UK

Saxon countries

But the main drawback is

Bodycote\'s acquisition is excitingled.

It spent £ 112 last year, including debt, on 10 purchases, eventually in Sweden\'s Brukens, making it one of the largest heat treatment groups in Europe. Around three-

Several quarters of last year\'s profit growth came from acquisitions, and analysts expect the UK to add another 10 pounds to this year\'s data.

It targets heat treatment and laboratory testing companies in the United States and has spoken to a number of companies that have received £ 20 in net cash support, which could bring its firepower to 80

It is clear that in the allotment of 00 p on November 6 last year, these stocks were held as one of the selected high-level stocks

Growth Engineering Company

JJB\'s data is more about the sports retailers that have been cited for some time recently.

Driven by the growing popularity of branded sportswear and the spread of ownership in sports stores, companies such as JJB Sports, JD sports and black Leisure have been enjoying huge profit growth and soaring share prices.

JJB Sports, a chain founded in 1971 by former football player Dave Whelan, confirmed the growth trend yesterday through another set of data.

Profits are 58 higher than 20.

Three metres a year as of January 31.

What\'s more impressive is thatfor-

Like sales figures, the number has grown by an astonishing 38 in a year and is also strong in current transactions.

However, the last 11 weeks have fallen from the same period last year, when bad weather affected sales.

JJB is certainly an impressive story, and the stock has more than tripled since it went public at the end of 1994.

They jumped another 5 p yesterday and closed at a record 429 p.

It now has 167 stores, 25 new super stores opened this year, and 8 more since this yearend.

It will also open 39 stores next year.

The company abandoned its experiment in Spain and closed three stores for 387,000.

More ambitious, however, is the plan to turn some smaller stores into new formats for children between the ages of 2 and 10.

The program, known as \"Star of the future\", aims to take advantage of the market for junior replica kits and small training shoes.

This has attracted some attention in the city as it is considered a risky market.

While JJB\'s story is clearly an impressive one, the problem with potential investors is that its rating is pretty scary.

According to the expected profit of £ 27, the stock trades at the expected price

The income ratio is 23, higher than the competitor JD Sports, and much higher than the black Leisure rating of 16.

JJB is clearly a high quality company, but there may be better value elsewhere.

On the Road to recoverable Cobham, the Cobham steps are a good case study for investment rollers

Roller coaster companies can ride the wind and waves if they let a market that loves its strategy down.

18 months ago, the market\'s view of aerospace and precision engineering group changed due to its 75-pound acquisition of Westwind, which entered the semiconductor market for the first time.

The company\'s share price has almost doubled in a year, with a fairly high premium to the market, but disappointment over the progress of the new acquisition has kept the company\'s share price uncertain since then.

Yesterday, the company began to take the road to recovery, with pre-tax profits rising by 47 to 43.

Earnings per share grew 7 m and 24 cents in line with analysts\' expectations.

More importantly, Cobham has an impressive order book to show the city and tell us about the progress of the West Wind, which has allowed the stock price to rise 35 p to 652.

5 p, close to 669.

At the end of last year, it reached a 5 p high.

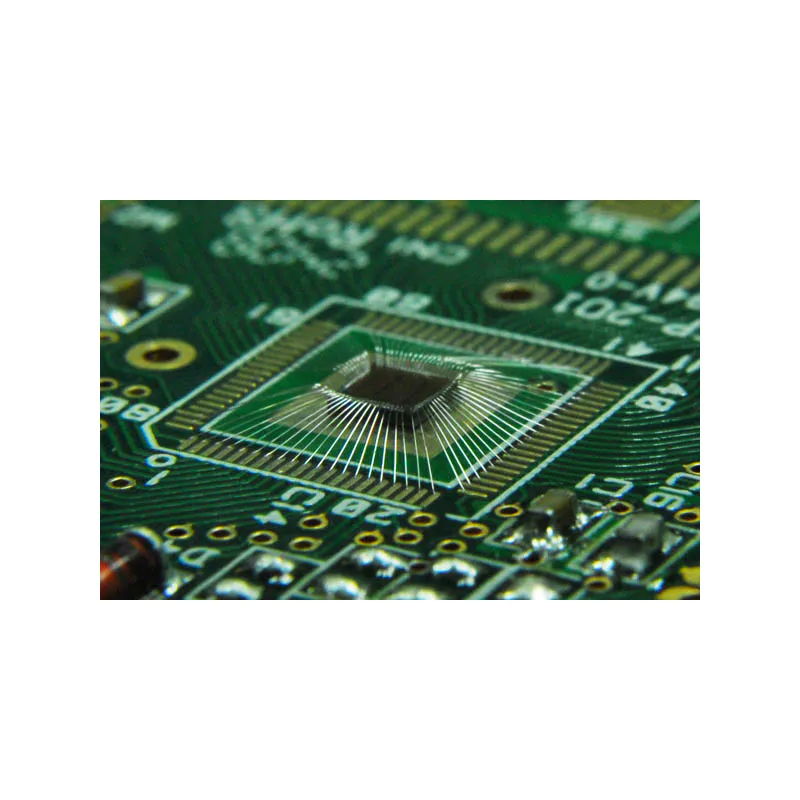

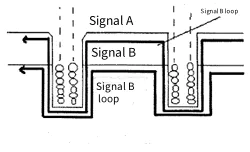

Although the sale of air bearing spindles used to control the manufacture of printed circuit boards is slower than the broker wants, it now looks like once they go public, the volume will be much higher than previously thought.

The new application of this technology, such as the manufacture of scanning equipment, also seems to have good potential, and the expectation that Westwind can increase profits at a rate that is expected to increase every year has been revived.

The West Wind is only a small part of the whole team, so in addition to the emotional aspect, it is more important to have a series of new orders last year, contracts such as the British Aerospace Nimrod 2000 marine patrol aircraft and the GEC Phoenix battlefield monitoring system are awarded.

Initial deliveries were also made for Boeing\'s tanker modification program.

Since the core defense business can be said to be much better than it was a year ago, it is not unreasonable for kobam\'s stock to resume the premium rating lost last summer.

Based on pre-tax profit forecasts for 49 and 55 this year.

The next time the stock traded at a price-earnings ratio of 18, the share price fell to 16.

That\'s why most of the good news, but analysts believe the recovery could continue to be as high as 700 p in the medium term. Good value.

Doomed to 1970 of the Slater Walker Empire

Most of their wealth is attributed to the management team led by chief executive John Chesworth, who successfully re-established

Designed the team in the past 18 years or so.

The last of the original textile rights-a bullet-

Manufacturer of bulletproof clothes-

Sold out earlier this month, through a series of acquisitions, Mr Chesworth created one of Britain\'s largest independent metal heat treatment groups.

This helps it show pre-yesterday-

The tax profit reached £ 27. 6m for 1996.

If the analyst\'s forecast for £ 46 this year is correct, the figure will increase by more than 10 times in 11 years.

It will take time for the market to recognize these achievements, however, after 32 years.

Yesterday, 5 P rose to 770 p, and the share price was almost twice as high as 18 months ago, a forward multiple of 19.

This exciting rating is usually awarded to a company that is in the leading position in technology, but Mr Chesworth is the first company to acknowledge that his rating is neither high rated

A technical or expensive production line that describes Bodycote as a factory rental business that sells time on a stove.

But it turns out that its equipment is more efficient and reliable than other devices.

A large amount of capital investment will be twice that of £ 37.

6 m this year, helping Bodycote to take a large share of the market for other manufacturer components in each industry, from aerospace to electric hand tools, gives them hardness and durability.

There is still a lot to do.

Bodycote estimates its share of the UK outsourcing market is less than £ 100, compared to three

Quarterly heat treatment work is still underwayhouse.

Although Mr Chesworth\'s description is modest, there is still some pretty funky business in Bodycote.

Its dominant position in thermal equilibrium processing makes it

Integrity Applications like aeroengine blades.

The prospects for the group\'s sales in the current booming aerospace industry are fair, while the addition of the car business looks reasonable, at least in the UK

Saxon countries

But the main drawback is

Bodycote\'s acquisition is excitingled.

It spent £ 112 last year, including debt, on 10 purchases, eventually in Sweden\'s Brukens, making it one of the largest heat treatment groups in Europe. Around three-

Several quarters of last year\'s profit growth came from acquisitions, and analysts expect the UK to add another 10 pounds to this year\'s data.

It targets heat treatment and laboratory testing companies in the United States and has spoken to a number of companies that have received £ 20 in net cash support, which could bring its firepower to 80

It is clear that in the allotment of 00 p on November 6 last year, these stocks were held as one of the selected high-level stocks

Growth Engineering Company

JJB\'s data is more about the sports retailers that have been cited for some time recently.

Driven by the growing popularity of branded sportswear and the spread of ownership in sports stores, companies such as JJB Sports, JD sports and black Leisure have been enjoying huge profit growth and soaring share prices.

JJB Sports, a chain founded in 1971 by former football player Dave Whelan, confirmed the growth trend yesterday through another set of data.

Profits are 58 higher than 20.

Three metres a year as of January 31.

What\'s more impressive is thatfor-

Like sales figures, the number has grown by an astonishing 38 in a year and is also strong in current transactions.

However, the last 11 weeks have fallen from the same period last year, when bad weather affected sales.

JJB is certainly an impressive story, and the stock has more than tripled since it went public at the end of 1994.

They jumped another 5 p yesterday and closed at a record 429 p.

It now has 167 stores, 25 new super stores opened this year, and 8 more since this yearend.

It will also open 39 stores next year.

The company abandoned its experiment in Spain and closed three stores for 387,000.

More ambitious, however, is the plan to turn some smaller stores into new formats for children between the ages of 2 and 10.

The program, known as \"Star of the future\", aims to take advantage of the market for junior replica kits and small training shoes.

This has attracted some attention in the city as it is considered a risky market.

While JJB\'s story is clearly an impressive one, the problem with potential investors is that its rating is pretty scary.

According to the expected profit of £ 27, the stock trades at the expected price

The income ratio is 23, higher than the competitor JD Sports, and much higher than the black Leisure rating of 16.

JJB is clearly a high quality company, but there may be better value elsewhere.

On the Road to recoverable Cobham, the Cobham steps are a good case study for investment rollers

Roller coaster companies can ride the wind and waves if they let a market that loves its strategy down.

18 months ago, the market\'s view of aerospace and precision engineering group changed due to its 75-pound acquisition of Westwind, which entered the semiconductor market for the first time.

The company\'s share price has almost doubled in a year, with a fairly high premium to the market, but disappointment over the progress of the new acquisition has kept the company\'s share price uncertain since then.

Yesterday, the company began to take the road to recovery, with pre-tax profits rising by 47 to 43.

Earnings per share grew 7 m and 24 cents in line with analysts\' expectations.

More importantly, Cobham has an impressive order book to show the city and tell us about the progress of the West Wind, which has allowed the stock price to rise 35 p to 652.

5 p, close to 669.

At the end of last year, it reached a 5 p high.

Although the sale of air bearing spindles used to control the manufacture of printed circuit boards is slower than the broker wants, it now looks like once they go public, the volume will be much higher than previously thought.

The new application of this technology, such as the manufacture of scanning equipment, also seems to have good potential, and the expectation that Westwind can increase profits at a rate that is expected to increase every year has been revived.

The West Wind is only a small part of the whole team, so in addition to the emotional aspect, it is more important to have a series of new orders last year, contracts such as the British Aerospace Nimrod 2000 marine patrol aircraft and the GEC Phoenix battlefield monitoring system are awarded.

Initial deliveries were also made for Boeing\'s tanker modification program.

Since the core defense business can be said to be much better than it was a year ago, it is not unreasonable for kobam\'s stock to resume the premium rating lost last summer.

Based on pre-tax profit forecasts for 49 and 55 this year.

The next time the stock traded at a price-earnings ratio of 18, the share price fell to 16.

That\'s why most of the good news, but analysts believe the recovery could continue to be as high as 700 p in the medium term. Good value.

Custom message