PRODUCTS

romney’s bain capital invested in companies that moved jobs overseas

by:Rocket PCB

2019-09-29

Bain Capital, Mitt Romney\'s financial firm, has invested in a range of companies that specifically shift jobs for American workers to low

Wage countries like China and India.

In the past 15 years that Mr. Romney has been actively involved in running Bain Capital, he founded a private equity company that, according to documents submitted to the Securities and Exchange Commission, owns companies, these companies are pioneers in shipping work practices from the United States to overseas call centers and factories that manufacture computer components.

While economists are debating whether it is inevitable for a generation to outsource a large number of American jobs, Romney has expressed regret over the loss of American jobs in recent months. S. economy.

He has repeatedly promised that he will protect American jobs by taking tough measures against China.

On February, he told workers at the Toledo fence factory: \"They have been able to shut down American businesses and kill American jobs . \".

\"If I were the president of the United States, it would be over.

Mr. Romney, speaking at a metal processing plant in Cincinnati last week, cited his experience as a businessman, saying he knew what it would take to bring his employer back to the United States.

\"For me, it\'s all for the good work of the American people and for a bright and prosperous future,\" he said . \".

For years, Romney\'s political opponents have tried to link him to outsourcing American jobs.

These political attacks tend to focus on Bain\'s participation in specific business transactions that result in unemployment.

But the Washington Post review of securities documents shows how much Bain invests in companies that specialize in helping other companies transfer or expand their business overseas.

While Bain is not the biggest player in outsourcing, the private equity company has been involved very early, as jobs start to accelerate from leaving the United States and new companies become maids of job outflows.

Bain has played a number of roles in helping these outsourcing companies, such as investing in venture capital, so that they can grow and grow in this fast-growing area and provide management and strategic business advice.

Over the past 20 years, American companies have significantly expanded their overseas business and supply networks, especially in Asia, while domestic labor is also decreasing.

The McKinsey Global Institute estimated $18 in 2006.

Global IT work is $4 billion and $11.

Business 4 billion-

Process Services have been transferred abroad.

While the export of jobs has damaged many workers and communities in the United States, outsourcing is a powerful economic force.

It often helps to lower the prices that American consumers pay for their products and creates a global supply chain that enables American consumersS.

The company is more flexible and profitable.

Romney campaign officials have repeatedly declined to comment on Bain\'s record of investing in outsourcing companies in the Romney era.

Campaign officials said it was unfair to criticize Romney for investing after Bain left the company, but did not address the investment on his watch.

In response to detailed questions about outsourcing investments, Bain spokesman Alex Stanton said, \"Bain Capital\'s business model has always been to build great companies and improve their operations.

We have helped 350 companies we have invested in, including more than 100 startups

Up-and-coming businesses generate $80 billion in revenue growth in the United States, while their revenue growth is more than double that of S & P and the United StatesS.

The economy of the past 28 years.

Before Romney left Bain Capital in 1999, he had run the company with the enthusiasm of his boss and attention to detail, known for being smart and hands-on. on management.

Bain\'s foray into outsourcing began in 1993 when the private equity firm took a stake in the company\'s software company.

After helping raise $93 million to buy the company, CSI.

CSI, which provides services to technology companies such as Microsoft, provides a range of services, including outsourcing customer support.

Initially, CSI hired the United States. S.

Workers provide these services, but in the medium term

1990 call centers are being set up abroad.

Two years after Bain invested in the company, China Securities merged with another company to set up a new company called Stream International Inc.

In the growing field of overseas call centers, Stream immediately became active.

According to the SEC document, Bain was originally a minority shareholder of Stream and actively operated the company to provide \"general manager and management services \".

To 1997, Stream runs three Technologies

A sec document shows that support for call centers in Europe is part of a Japanese call center joint venture.

\"The Company believes that the trend of outsourcing technical support in the United StatesS.

\"The international market is also happening,\" the SEC document said . \".

Stream continues to expand its overseas call center.

Bain\'s role has also grown over time.

Later shareholders were in Salt Lake City for months after Mr. Romney left Bain in 1999.

In 2001, Bain sold its stake in Stream after further expanding its call center operations in Europe and Asia.

The company merger that created Stream also spawned another related business, called Modus Media Inc.

Help companies outsource their manufacturing industry.

Modus Media, a subsidiary of Stream, became an independent company in early 1998.

Bain is the largest shareholder, according to SEC documents.

The media is developing rapidly.

On December 1997, Microsoft announced a contract with Microsoft to produce software and training products at a center in Australia.

Modus Media said it has served Microsoft in Singapore, South Korea, Japan and Taiwan, as well as in Asia in Europe and the United States.

Two years later, Modus Media told SEC that it was working for IBM, Sun Microsystems, Hewlett-Packard Co.

Dell Computer

The document disclosed that Modus operates on four continents, including Asian facilities in Singapore, Taiwan, China and South Korea, European facilities in Ireland and France, and a center in Australia.

\"Technology companies in particular are increasingly seeking to outsource the business processes involved in the supply chain,\" the document said . \". “. . .

We provide a range of services to our customers

Stop shopping for their outsourcing requirements.

According to a press release released by Modus Media on 1997, it expanded its outsourcing services in close consultation with Bain.

Terry Leahy, chairman and chief executive of Modus, said in a press release that he would \"work closely with Bain to advance strategic expansion.

At that time, three Bain directors served on the company\'s board of directors.

The global expansion that Mr. Romney started at Bain after he left continues.

On 2000, the company announced that it would open a new factory in Guadalajara, Mexico, and expand in China, Malaysia, Taiwan and South Korea.

In addition to being interested in companies specializing in outsourcing services, Bain has also invested in companies that transfer or expand their business outside the United States.

One of them is GT Bicycle, a California bicycle manufacturer.

Bain acquired in 1993.

According to the SEC, the growing company relies on Asian labor.

Two years later, Bain helped it go public as the company continued to expand.

In 1998, Bain had a 22% stake in GT, three members of the board of directors, and bicycle manufacturers sold it to Schwinn as part of a broader trend in the bicycle industry to shift to the Chinese workforce, the company also moved most of its manufacturing overseas.

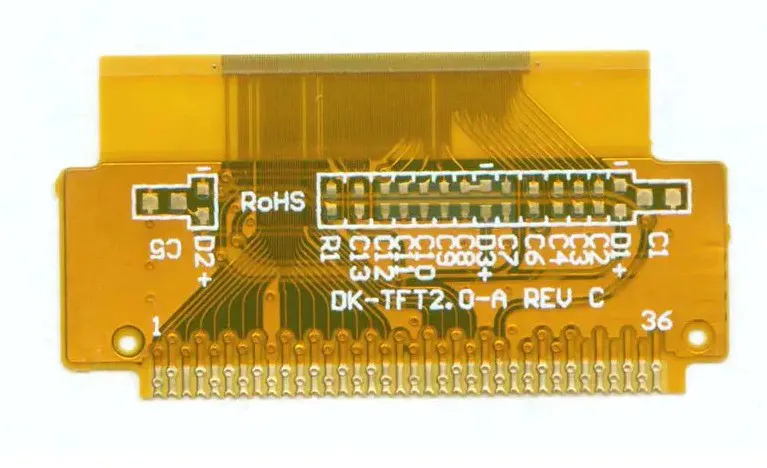

Another investment by Bain is SMTC Corp. , an electronics maker . .

In June 1998, Mr. Romney\'s last year at Bain, his private equity firm bought a Colorado manufacturer that specializes in assembling printed circuit boards.

This is one of several preliminary steps in 1998, and a year later, five months after Romney left Bain, it will lead to a merger.

Colorado acquired SMTC in July 1999.

The SEC file shows.

Bain has become the largest shareholder of SMTC and has three seats on its board of directors.

Less than a year after Bain took over, SMTC told the SEC that it was expanding production in Ireland and Mexico.

SMTC explained in its prospectus for the year that it has the ability to meet the growing demand of other manufacturers for overseas board production.

Communications and Networking companies are \"significantly increasing the number of manufacturing they outsource, and we believe our technical capabilities and global manufacturing platforms are well positioned to take advantage of this opportunity, the company said.

\"Just as Romney ended his term at Bain, he reached a climax with South Korea\'s Hyundai Electronics industry in negotiations for $0. 55 billion in U. S. cars. S.

Chippac, a subsidiary that manufactures, tests and packs computer chips in Asia.

A month after Romney left Bain, the deal was announced.

The report submitted to SEC at the end of 1999 shows that Chippac has factories in Korea and China, responsible for the marketing and supply of the company\'s Asian market.

Computer chips.

The vast majority of Chippac customers are US customers. S.

Companies including Intel, IBM and Lucent Technologies.

A document submitted to the SEC shows the commitment that Chippac provides to investors.

\"Historically, semiconductor companies have produced semiconductors mainly in their own factories,\" the document said . \".

\"Today, at least part of most major semiconductor manufacturers use independent providers of packaging and testing services. . . needs.

We expect this trend to continue.

Research editor Alice Crites contributed to the article.

Wage countries like China and India.

In the past 15 years that Mr. Romney has been actively involved in running Bain Capital, he founded a private equity company that, according to documents submitted to the Securities and Exchange Commission, owns companies, these companies are pioneers in shipping work practices from the United States to overseas call centers and factories that manufacture computer components.

While economists are debating whether it is inevitable for a generation to outsource a large number of American jobs, Romney has expressed regret over the loss of American jobs in recent months. S. economy.

He has repeatedly promised that he will protect American jobs by taking tough measures against China.

On February, he told workers at the Toledo fence factory: \"They have been able to shut down American businesses and kill American jobs . \".

\"If I were the president of the United States, it would be over.

Mr. Romney, speaking at a metal processing plant in Cincinnati last week, cited his experience as a businessman, saying he knew what it would take to bring his employer back to the United States.

\"For me, it\'s all for the good work of the American people and for a bright and prosperous future,\" he said . \".

For years, Romney\'s political opponents have tried to link him to outsourcing American jobs.

These political attacks tend to focus on Bain\'s participation in specific business transactions that result in unemployment.

But the Washington Post review of securities documents shows how much Bain invests in companies that specialize in helping other companies transfer or expand their business overseas.

While Bain is not the biggest player in outsourcing, the private equity company has been involved very early, as jobs start to accelerate from leaving the United States and new companies become maids of job outflows.

Bain has played a number of roles in helping these outsourcing companies, such as investing in venture capital, so that they can grow and grow in this fast-growing area and provide management and strategic business advice.

Over the past 20 years, American companies have significantly expanded their overseas business and supply networks, especially in Asia, while domestic labor is also decreasing.

The McKinsey Global Institute estimated $18 in 2006.

Global IT work is $4 billion and $11.

Business 4 billion-

Process Services have been transferred abroad.

While the export of jobs has damaged many workers and communities in the United States, outsourcing is a powerful economic force.

It often helps to lower the prices that American consumers pay for their products and creates a global supply chain that enables American consumersS.

The company is more flexible and profitable.

Romney campaign officials have repeatedly declined to comment on Bain\'s record of investing in outsourcing companies in the Romney era.

Campaign officials said it was unfair to criticize Romney for investing after Bain left the company, but did not address the investment on his watch.

In response to detailed questions about outsourcing investments, Bain spokesman Alex Stanton said, \"Bain Capital\'s business model has always been to build great companies and improve their operations.

We have helped 350 companies we have invested in, including more than 100 startups

Up-and-coming businesses generate $80 billion in revenue growth in the United States, while their revenue growth is more than double that of S & P and the United StatesS.

The economy of the past 28 years.

Before Romney left Bain Capital in 1999, he had run the company with the enthusiasm of his boss and attention to detail, known for being smart and hands-on. on management.

Bain\'s foray into outsourcing began in 1993 when the private equity firm took a stake in the company\'s software company.

After helping raise $93 million to buy the company, CSI.

CSI, which provides services to technology companies such as Microsoft, provides a range of services, including outsourcing customer support.

Initially, CSI hired the United States. S.

Workers provide these services, but in the medium term

1990 call centers are being set up abroad.

Two years after Bain invested in the company, China Securities merged with another company to set up a new company called Stream International Inc.

In the growing field of overseas call centers, Stream immediately became active.

According to the SEC document, Bain was originally a minority shareholder of Stream and actively operated the company to provide \"general manager and management services \".

To 1997, Stream runs three Technologies

A sec document shows that support for call centers in Europe is part of a Japanese call center joint venture.

\"The Company believes that the trend of outsourcing technical support in the United StatesS.

\"The international market is also happening,\" the SEC document said . \".

Stream continues to expand its overseas call center.

Bain\'s role has also grown over time.

Later shareholders were in Salt Lake City for months after Mr. Romney left Bain in 1999.

In 2001, Bain sold its stake in Stream after further expanding its call center operations in Europe and Asia.

The company merger that created Stream also spawned another related business, called Modus Media Inc.

Help companies outsource their manufacturing industry.

Modus Media, a subsidiary of Stream, became an independent company in early 1998.

Bain is the largest shareholder, according to SEC documents.

The media is developing rapidly.

On December 1997, Microsoft announced a contract with Microsoft to produce software and training products at a center in Australia.

Modus Media said it has served Microsoft in Singapore, South Korea, Japan and Taiwan, as well as in Asia in Europe and the United States.

Two years later, Modus Media told SEC that it was working for IBM, Sun Microsystems, Hewlett-Packard Co.

Dell Computer

The document disclosed that Modus operates on four continents, including Asian facilities in Singapore, Taiwan, China and South Korea, European facilities in Ireland and France, and a center in Australia.

\"Technology companies in particular are increasingly seeking to outsource the business processes involved in the supply chain,\" the document said . \". “. . .

We provide a range of services to our customers

Stop shopping for their outsourcing requirements.

According to a press release released by Modus Media on 1997, it expanded its outsourcing services in close consultation with Bain.

Terry Leahy, chairman and chief executive of Modus, said in a press release that he would \"work closely with Bain to advance strategic expansion.

At that time, three Bain directors served on the company\'s board of directors.

The global expansion that Mr. Romney started at Bain after he left continues.

On 2000, the company announced that it would open a new factory in Guadalajara, Mexico, and expand in China, Malaysia, Taiwan and South Korea.

In addition to being interested in companies specializing in outsourcing services, Bain has also invested in companies that transfer or expand their business outside the United States.

One of them is GT Bicycle, a California bicycle manufacturer.

Bain acquired in 1993.

According to the SEC, the growing company relies on Asian labor.

Two years later, Bain helped it go public as the company continued to expand.

In 1998, Bain had a 22% stake in GT, three members of the board of directors, and bicycle manufacturers sold it to Schwinn as part of a broader trend in the bicycle industry to shift to the Chinese workforce, the company also moved most of its manufacturing overseas.

Another investment by Bain is SMTC Corp. , an electronics maker . .

In June 1998, Mr. Romney\'s last year at Bain, his private equity firm bought a Colorado manufacturer that specializes in assembling printed circuit boards.

This is one of several preliminary steps in 1998, and a year later, five months after Romney left Bain, it will lead to a merger.

Colorado acquired SMTC in July 1999.

The SEC file shows.

Bain has become the largest shareholder of SMTC and has three seats on its board of directors.

Less than a year after Bain took over, SMTC told the SEC that it was expanding production in Ireland and Mexico.

SMTC explained in its prospectus for the year that it has the ability to meet the growing demand of other manufacturers for overseas board production.

Communications and Networking companies are \"significantly increasing the number of manufacturing they outsource, and we believe our technical capabilities and global manufacturing platforms are well positioned to take advantage of this opportunity, the company said.

\"Just as Romney ended his term at Bain, he reached a climax with South Korea\'s Hyundai Electronics industry in negotiations for $0. 55 billion in U. S. cars. S.

Chippac, a subsidiary that manufactures, tests and packs computer chips in Asia.

A month after Romney left Bain, the deal was announced.

The report submitted to SEC at the end of 1999 shows that Chippac has factories in Korea and China, responsible for the marketing and supply of the company\'s Asian market.

Computer chips.

The vast majority of Chippac customers are US customers. S.

Companies including Intel, IBM and Lucent Technologies.

A document submitted to the SEC shows the commitment that Chippac provides to investors.

\"Historically, semiconductor companies have produced semiconductors mainly in their own factories,\" the document said . \".

\"Today, at least part of most major semiconductor manufacturers use independent providers of packaging and testing services. . . needs.

We expect this trend to continue.

Research editor Alice Crites contributed to the article.

Custom message