1. Supply-Side Tightening: Manufacturers Cut OutputOne of the most important reasons behind the price increase was intentional production cuts by major memory manufacturers.After a prolonged period of oversupply and declining prices, leading DRAM and NAND producers reduced wafer starts to stabilize profitability. This strategy gradually tightened supply and pushed prices upward.Global Memory Supply Trend (Market-Based Estimates)

Year

NAND Supply Growth

DRAM Supply Growth

2023

Severe Oversupply

Oversupply

2024

Supply Cuts Initiated

Supply Cuts Initiated

2025

Tight / Disciplined

Tight / Disciplined

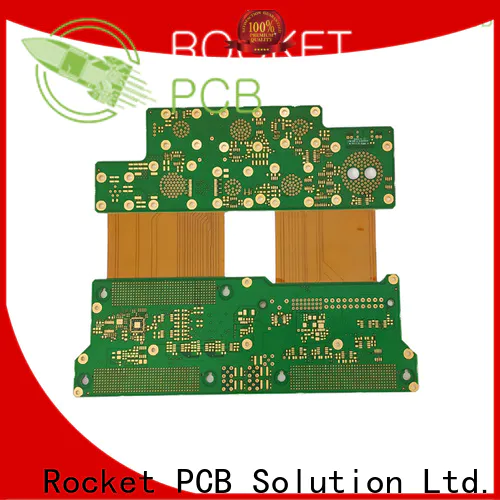

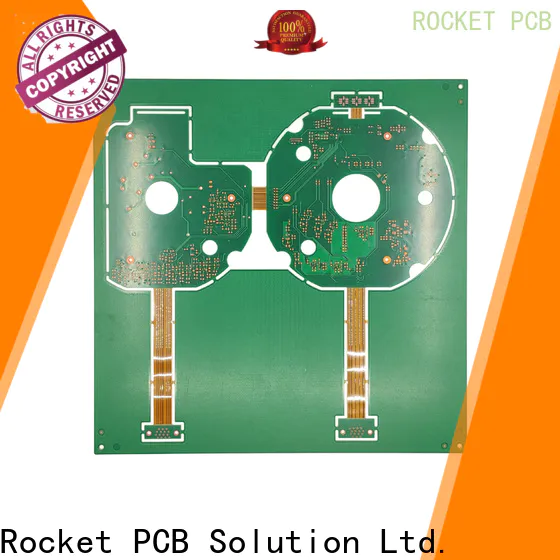

As inventory levels normalized, the market quickly shifted from excess supply to balanced -- and in some segments, constrained.2. Demand Recovery from AI, Data Centers, and ServersAccording to industry tracking data, DRAM contract prices increased by up to ~170% year-over-year, while NAND flash and SSD pricing rose approximately 60-100%, depending on density, interface, and application segment.At the same time, demand rebounded strongly, especially from:AI servers and high-performance computing (HPC)Cloud data centersEnterprise storage systemsAutomotive and industrial electronicsAI workloads, in particular, require large-capacity, high-speed storage, dramatically increasing per-system memory consumption.Storage Demand Growth by Application (YoY)Application AreaStorage Demand TrendConsumer ElectronicsStableCloud Data CentersStrong GrowthAI / HPC ServersRapid GrowthAutomotive ElectronicsSteady GrowthThis demand growth absorbed available inventory faster than expected, accelerating price increases.3. Technology Transitions Increased Manufacturing CostsAnother factor was the industry's transition to more advanced process nodes and higher-layer NAND structures.While these technologies improve performance and density, they also:Increase equipment and R&D costsExtend production ramp-up timesReduce short-term yields during transitionsCost Comparison: Legacy vs Advanced Storage NodesTechnologyRelative Manufacturing CostYield StabilityLegacy NANDLowerHighHigh-Layer NANDHigherMediumAdvanced DRAM NodesHigherMediumThese higher costs were gradually passed along the supply chain.4. Inventory Restocking Across the Supply ChainDuring the previous downturn, many OEMs and EMS companies deliberately kept inventories low. Once prices stabilized, restocking began almost simultaneously, further tightening short-term supply.This created a classic cycle:Prices stop fallingBuyers rush to secure supplyShort-term demand spikesPrices rise faster than expected5. What This Means for Hardware and PCB ManufacturingRising storage prices don't just affect memory suppliers -- they influence total system costs, including:Server and industrial PC BOMsStorage controller and high-speed PCB designsLead-time planning and procurement strategiesAt Rocket-PCB, we've observed growing demand for:High-speed, high-layer-count PCBsServer and storage backplane designsTighter impedance control and signal integrity requirementsEarly design optimization and close supplier collaboration are becoming more important than ever.Looking Ahead: Will Prices Keep Rising?While short-term volatility may continue, most industry signals ppoint toward:More disciplined supply managementStructurally higher demand driven by AIFewer extreme boom-and-bust cyclesFor OEMs and system designers, the key takeaway is clear: plan earlier, design smarter, This article reflects general industry trends and market observations. For project-specific advice on PCB design and manufacturing for storage and server applications, feel free to reach out to the Rocket-PCB team.

Read More>>

All Products

-

Best PRODUCTS Manufacturer

-

Certificated Hybrid PCB Wholesale

-

Wire Bonding PCB Bulk

-

Top Thermal Management PCB

-

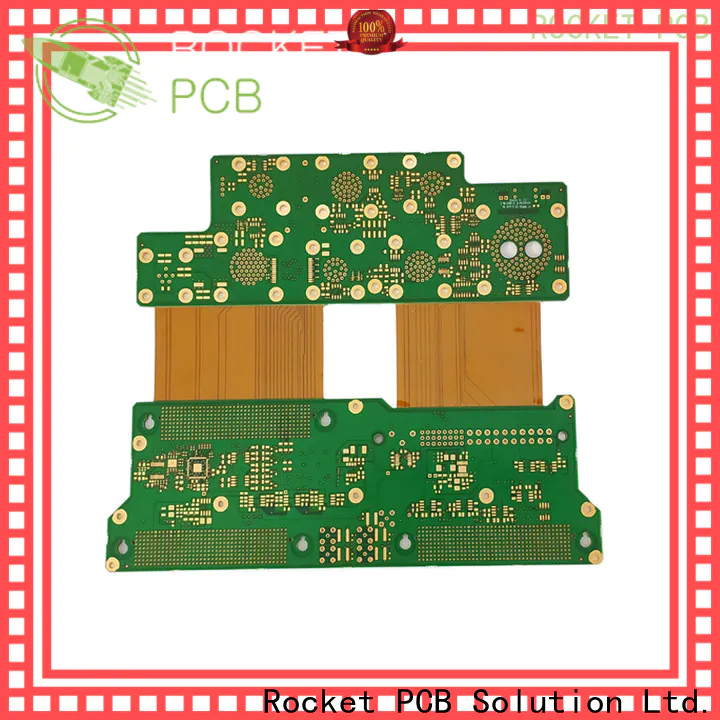

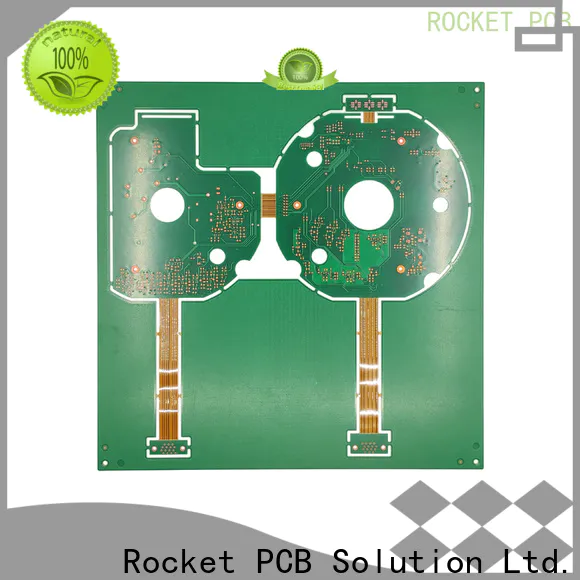

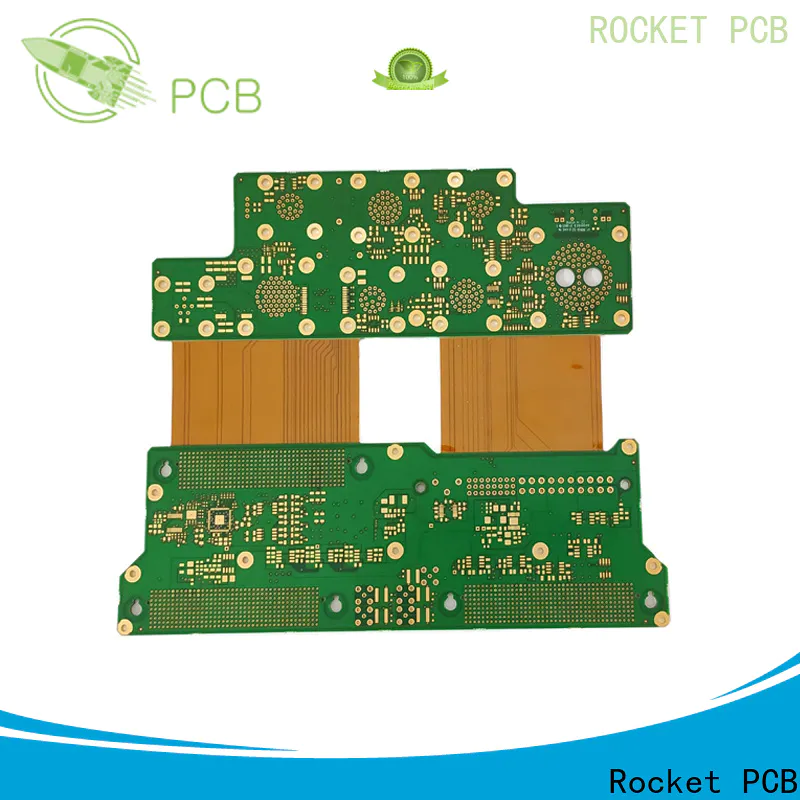

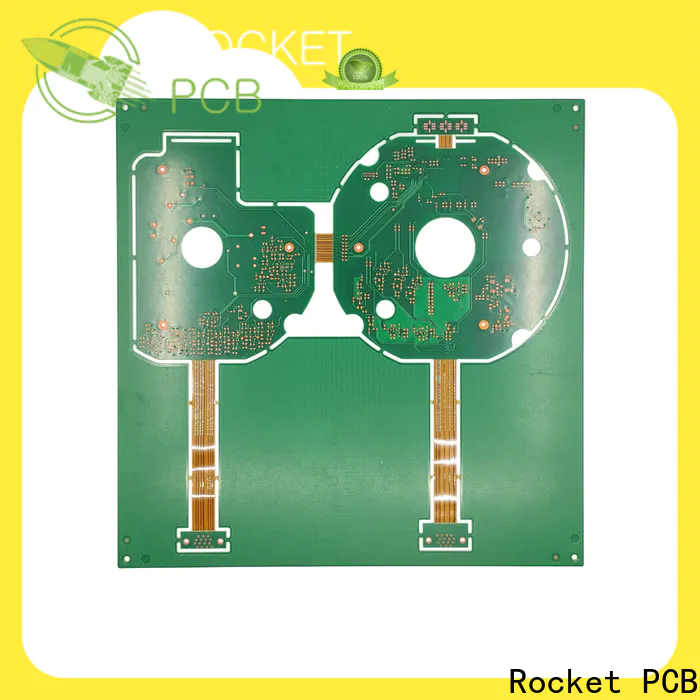

Quality Rigid-flex PCB Wholesale

-

Customized RF&Microwave PCB

-

Top Multilayer PCB Warranty

-

Quality Aluminum PCB

-

Top Large PCB Bulk

-

Quality IC Substrate PCB Wholesale

-

Certificated Heavy Copper PCB

-

Top HDI PCB

-

Gold Finger PCB Supplier

-

Hot Flex PCB

-

Best Embedded PCB

-

Single&Double Sided PCB Factory

-

Top Ceramic PCB

-

Cavity PCB For sell

-

Hot Backplane PCB For sell

-

Any-layer PCB Factory

-

Certificated Hybrid PCB Wholesale