supply chain reaction: trade war refugees race to relocate to vietnam, thailand

by:Rocket PCB

2019-10-26

Hong Kong/Bangkok (Reuters)-

Fred Perotta has spent four years building a network of Chinese suppliers for his fashion backpack range, but once the United States announces tariffs on almost half of Chinese imports, he started looking for suppliers in other countries.

The process has now advanced so far, even if the United StatesS.

President Donald Trump and Chinese President Xi Jinping called for a ceasefire at this week\'s G20 summityear-old said.

Perrotta\'s company, Tortuga, has joined what industry experts call the biggest cross-cutting shift.

China\'s border supply chain since joining the World Trade Organization in 2001.

The shift is creating fierce competition to secure new facilities in neighboring countries and rebuild supply chains outside of China, the world\'s fifth-largest manufacturing base.

Perrotta said over the phone in Oakland, California: \"Everyone is nervous and running around . \" He recently received the first samples from a potential new supplier in Vietnam. “Long-

We may change everything.

\"This competition is driven by the increasing risk in the United States. S.

Tariffs on China worry that nearby emerging economies can only accommodate new businesses \"first come, first served.

Vietnam and Thailand are becoming preferred destinations, but they still face capacity constraints from red to red

Skilled labor and limited infrastructure.

Reuters interviews with more than a dozen company executives, trade lawyers and industry lobby groups show that activity across Asia has been unusually fierce in recent months: executives have asked for product samples, visit the industrial park to hire lawyers and meet officials.

Hong Kong, June-

Wanhua Holdings, listed furniture manufacturer (1999. HK)

Acquired a factory in Vietnam for $68 million, and earlier this month said it planned to nearly double production capacity to 373,000 m² by the end of 2019.

\"The acquisition is to mitigate the risks posed by tariffs,\" manhua said in a statement . \". Vietnam-

BW industrial, a US-based industrial property developer, said the number of investigations has surged since October, and all its factories are now leased.

\"Manufacturers are from all over the world, but they all have production plants in China and need to start production as soon as possible,\" BW Industrial\'s sales manager Chris Truong told Reuters . \".

In Thailand, SVI a Pcl (SVI. BK)

The company offers electronic products and manufacturing solutions. The company said it had just selected four new deals worth about $100 million with existing customers with operations in China.

\"The trade war is beneficial,\" said Pongsak Lothongkam, CEO.

\"We have been approached by many companies, so we have to give priority.

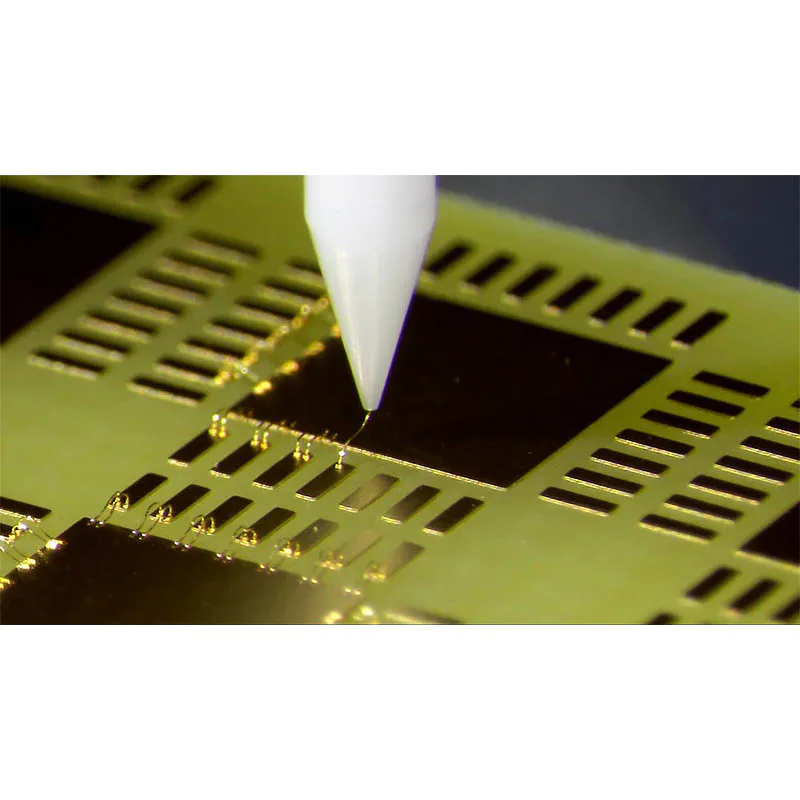

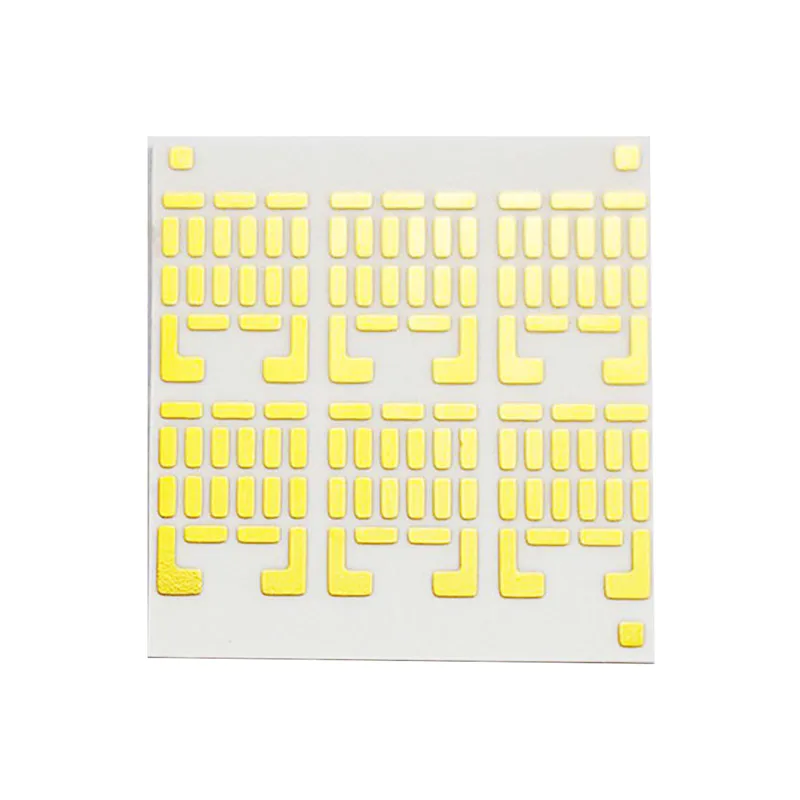

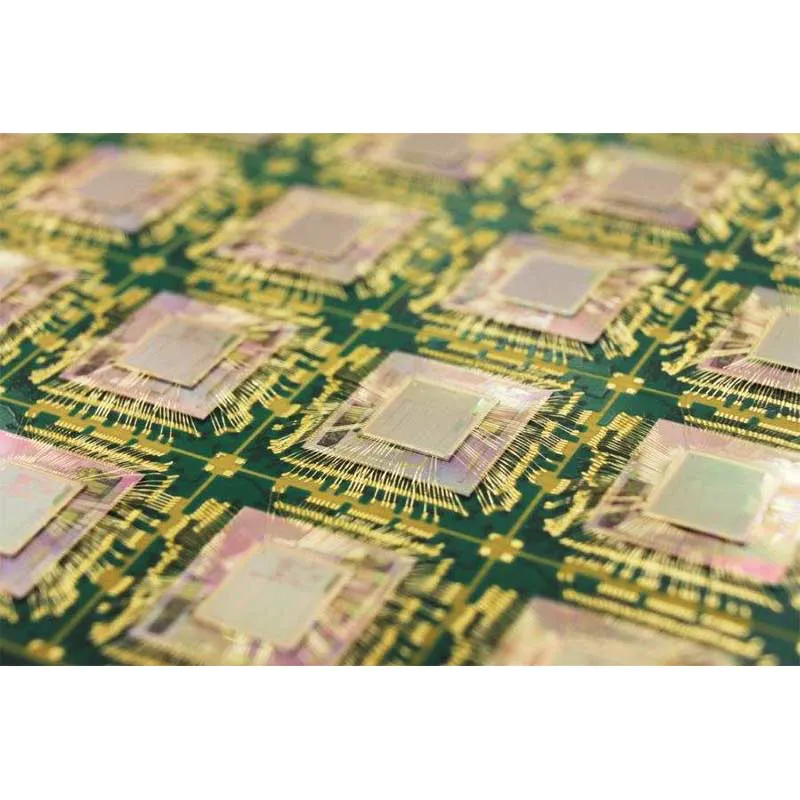

KCE Electronics (KCE. BK)

Largest manufacturer of printed circuit boards in Southeast AsiaPCBs)

Has been contacted by the United StatesS.

CEO Pitharn Ongkosit told Reuters that companies that want to find new suppliers in China to replace suppliers.

\"This is a good opportunity.

Many customers contact us to ask about our products and prices.

But it hasn\'t been sold yet because it takes time . \"

Star micro-electronics Pcl (SMT. BK)

Another electronics manufacturing service provider in Thailand is also getting new business. “Two (or)

The three companies will begin to relocate their production bases. out of China)

We were quick, \"said Peerapol wilaiwonstien, CEO.

Cambodia has also attracted interest, Parsippany, New Jersey.

Kent International, a US-based bicycle manufacturer, transferred Chinese production to Southeast Asian countries.

\"We have a lot of business in the US,\" Arnold Kamler, the company\'s major shareholder and chief executive, told Reuters.

\"There is no choice but to transfer production from China as soon as possible. ” The re-

With the transformation of China\'s economy to service, consumption and high consumption, procurement and relocation work marks the acceleration of established trendsTechnical production.

Stephen Lamar, executive vice president, said: \"We are at the forefront of the biggest procurement disruption our generation has seen . \"

President of the American Apparel and Footwear Association, whose more than 1,000 members contribute more than $400 billion annually to the United StatesS. retail sales. “The No.

One thing I \'ve heard from the company is this: We \'ve been talking about diversifying from China for years, and now we have to really do that.

\"It will take a few years to transform production to complete: the company needs to get funds, find the right supplier, and organize new logistics --

In dealing with new legal and accounting issues in a country that they may not know much about.

\"Any move away from China will be very slow and very uncertain,\" said Aidan Yao, senior Asia emerging markets economist at AXA Investment Manager.

Low-tech products and low-value manufacturing will be the fastest migration and higher value

UBS said in a report earlier this month that due to high R & D costs and competitive Chinese labor costs, new exports in the machinery, transport and IT categories could take decades to re-enter

However, a regional customer survey conducted by Citi last month showed that more than half of customers have adjusted their supply chain to limit the turmoil in their business.

Sally Peng, a trade lawyer at Sandler, Travis and Rosenberg, said China\'s maturity in areas such as automation means no country can replace China.

\"So everyone is looking for a strategy for China to add one, two, and three countries, all the way to Africa,\" she said . \".

When Trump and Xi will meet this week during the G20 summit in Argentina\'s capital, Argentina, businesses have little hope for a truce in trade disputes.

In fact, Trump said on Monday that he expects to continue to impose tariffs on $200 billion of Chinese imports, up from the current 25% to 10%.

While Chinese export data show little sign of the impact of the trade war, some economists say it is because companies are eager to ship goods out before imposing more tariffs.

To be sure, Asia\'s smaller emerging economies do not necessarily scoff at the prospect of a worsening trade war between the world\'s top two economies.

Growth in Southeast Asia and Taiwan, Japan and South Korea slowed in the third quarter, partly because of the trade war.

For example, Thailand\'s electronic integrated circuit exports to the United States rose 4% in October, but exports to China fell 38%.

Vietnam\'s manufacturing boom index is the highest in Asia, but far below its peak. (

Asian manufacturing: Vietnamtmsnrt. rs/2PMSvzi)

The lack of infrastructure is also a problem for countries seeking to resume their operations.

Thailand ranked 41 in the World Bank\'s infrastructure quality rankings, 47 in Vietnam and 20 in China.

Bangkok is seeking to address this issue through its Eastern Economic Corridor, an ambitious $45 billion development project that plans to improve deep water ports, airports and railways.

In addition to infrastructure bottlenecks, red tape

Especially in Vietnam.

It\'s still hard to navigate and it\'s not easy to get skilled labor.

The unemployment rate in Vietnam is 2. 2 percent.

Thailand is even lower.

\"The proportion of unskilled labor in Vietnam is still very large and there is no effective plan to improve the problem, I don\'t think there is any major change in five or even ten years, nguyen oc Hai, vice chairman of the Vietnam Electronics Industry Association, said.

\"In the face of the fourth industrial revolution, it is doubtful whether cheap labor will still be one of Vietnam\'s strengths. ” ($1 = 32. 9800 baht)

Fred Perotta has spent four years building a network of Chinese suppliers for his fashion backpack range, but once the United States announces tariffs on almost half of Chinese imports, he started looking for suppliers in other countries.

The process has now advanced so far, even if the United StatesS.

President Donald Trump and Chinese President Xi Jinping called for a ceasefire at this week\'s G20 summityear-old said.

Perrotta\'s company, Tortuga, has joined what industry experts call the biggest cross-cutting shift.

China\'s border supply chain since joining the World Trade Organization in 2001.

The shift is creating fierce competition to secure new facilities in neighboring countries and rebuild supply chains outside of China, the world\'s fifth-largest manufacturing base.

Perrotta said over the phone in Oakland, California: \"Everyone is nervous and running around . \" He recently received the first samples from a potential new supplier in Vietnam. “Long-

We may change everything.

\"This competition is driven by the increasing risk in the United States. S.

Tariffs on China worry that nearby emerging economies can only accommodate new businesses \"first come, first served.

Vietnam and Thailand are becoming preferred destinations, but they still face capacity constraints from red to red

Skilled labor and limited infrastructure.

Reuters interviews with more than a dozen company executives, trade lawyers and industry lobby groups show that activity across Asia has been unusually fierce in recent months: executives have asked for product samples, visit the industrial park to hire lawyers and meet officials.

Hong Kong, June-

Wanhua Holdings, listed furniture manufacturer (1999. HK)

Acquired a factory in Vietnam for $68 million, and earlier this month said it planned to nearly double production capacity to 373,000 m² by the end of 2019.

\"The acquisition is to mitigate the risks posed by tariffs,\" manhua said in a statement . \". Vietnam-

BW industrial, a US-based industrial property developer, said the number of investigations has surged since October, and all its factories are now leased.

\"Manufacturers are from all over the world, but they all have production plants in China and need to start production as soon as possible,\" BW Industrial\'s sales manager Chris Truong told Reuters . \".

In Thailand, SVI a Pcl (SVI. BK)

The company offers electronic products and manufacturing solutions. The company said it had just selected four new deals worth about $100 million with existing customers with operations in China.

\"The trade war is beneficial,\" said Pongsak Lothongkam, CEO.

\"We have been approached by many companies, so we have to give priority.

KCE Electronics (KCE. BK)

Largest manufacturer of printed circuit boards in Southeast AsiaPCBs)

Has been contacted by the United StatesS.

CEO Pitharn Ongkosit told Reuters that companies that want to find new suppliers in China to replace suppliers.

\"This is a good opportunity.

Many customers contact us to ask about our products and prices.

But it hasn\'t been sold yet because it takes time . \"

Star micro-electronics Pcl (SMT. BK)

Another electronics manufacturing service provider in Thailand is also getting new business. “Two (or)

The three companies will begin to relocate their production bases. out of China)

We were quick, \"said Peerapol wilaiwonstien, CEO.

Cambodia has also attracted interest, Parsippany, New Jersey.

Kent International, a US-based bicycle manufacturer, transferred Chinese production to Southeast Asian countries.

\"We have a lot of business in the US,\" Arnold Kamler, the company\'s major shareholder and chief executive, told Reuters.

\"There is no choice but to transfer production from China as soon as possible. ” The re-

With the transformation of China\'s economy to service, consumption and high consumption, procurement and relocation work marks the acceleration of established trendsTechnical production.

Stephen Lamar, executive vice president, said: \"We are at the forefront of the biggest procurement disruption our generation has seen . \"

President of the American Apparel and Footwear Association, whose more than 1,000 members contribute more than $400 billion annually to the United StatesS. retail sales. “The No.

One thing I \'ve heard from the company is this: We \'ve been talking about diversifying from China for years, and now we have to really do that.

\"It will take a few years to transform production to complete: the company needs to get funds, find the right supplier, and organize new logistics --

In dealing with new legal and accounting issues in a country that they may not know much about.

\"Any move away from China will be very slow and very uncertain,\" said Aidan Yao, senior Asia emerging markets economist at AXA Investment Manager.

Low-tech products and low-value manufacturing will be the fastest migration and higher value

UBS said in a report earlier this month that due to high R & D costs and competitive Chinese labor costs, new exports in the machinery, transport and IT categories could take decades to re-enter

However, a regional customer survey conducted by Citi last month showed that more than half of customers have adjusted their supply chain to limit the turmoil in their business.

Sally Peng, a trade lawyer at Sandler, Travis and Rosenberg, said China\'s maturity in areas such as automation means no country can replace China.

\"So everyone is looking for a strategy for China to add one, two, and three countries, all the way to Africa,\" she said . \".

When Trump and Xi will meet this week during the G20 summit in Argentina\'s capital, Argentina, businesses have little hope for a truce in trade disputes.

In fact, Trump said on Monday that he expects to continue to impose tariffs on $200 billion of Chinese imports, up from the current 25% to 10%.

While Chinese export data show little sign of the impact of the trade war, some economists say it is because companies are eager to ship goods out before imposing more tariffs.

To be sure, Asia\'s smaller emerging economies do not necessarily scoff at the prospect of a worsening trade war between the world\'s top two economies.

Growth in Southeast Asia and Taiwan, Japan and South Korea slowed in the third quarter, partly because of the trade war.

For example, Thailand\'s electronic integrated circuit exports to the United States rose 4% in October, but exports to China fell 38%.

Vietnam\'s manufacturing boom index is the highest in Asia, but far below its peak. (

Asian manufacturing: Vietnamtmsnrt. rs/2PMSvzi)

The lack of infrastructure is also a problem for countries seeking to resume their operations.

Thailand ranked 41 in the World Bank\'s infrastructure quality rankings, 47 in Vietnam and 20 in China.

Bangkok is seeking to address this issue through its Eastern Economic Corridor, an ambitious $45 billion development project that plans to improve deep water ports, airports and railways.

In addition to infrastructure bottlenecks, red tape

Especially in Vietnam.

It\'s still hard to navigate and it\'s not easy to get skilled labor.

The unemployment rate in Vietnam is 2. 2 percent.

Thailand is even lower.

\"The proportion of unskilled labor in Vietnam is still very large and there is no effective plan to improve the problem, I don\'t think there is any major change in five or even ten years, nguyen oc Hai, vice chairman of the Vietnam Electronics Industry Association, said.

\"In the face of the fourth industrial revolution, it is doubtful whether cheap labor will still be one of Vietnam\'s strengths. ” ($1 = 32. 9800 baht)

Custom message